17.12.08

Interest Rate Is No More Cost Of Borrowing.

The time now is 2.45pm in New York and Federal Reserve just came out with a statement that Fed Rate will be cut to between 0 and 0.25%.

Welcome to a new world! We actually have the second developed country in the history of mankind that kept interest rate lower than 0.5%, USA. I have mentioned many times why Japan manage to kept interest rate lower than 0.5% and why US can't so I am not gonna do that again.

We need to rewrite all Economic text book since interest is no more a cost of borrowing if Fed rate is 0%. Banks can borrow money without cost!

Here's a common sense question: if you can borrow money without cost, what will you do?

You will borrow as much money as you can!

So here's another question: who will lend you money since everyone wants to borrow money?

The answer: Federal Reserve since they are the only agency with authority to print money.

Money supply will increase rapidly and out of control that way.

Furthermore, US is the biggest debtor in the world. How can they repay their debt? Who will want to lend them money? Who will invest in their T-bill? Who will invest in their money market?

Imagine this: 1% interest rate in 2003 created this bubble. What will 0-0.25% interest rate now create?

It will create a huge amount of mal-investment greater than dot-com bubble, housing bubble and credit bubble. Money supply will be out of control and Dollar will fall like stone. Inflation rate will shoot up dramatically after this. I won't be surprise if US inflation rate will be as high as Zimbabwe. After that interest rate will shoot to moon just like Zimbabwe and US will no longer become the most powerful country in the world.

One good news though, stock market will keep rising since high inflation rate will push stock price higher but that's not the point. Zimbabwe stock exchange surge from around 33000 point to more than 4,000,000 point from April 2006 to April 2007 but somehow inflation rate rise more than that so investor won't get anything from that rally. What is the point of earning some dollar from investment in stock market when a load of bread cost 200 million dollar?

I am not saying US will become Zimbabwe but they certainly have all the ingredients. Not even Japanese government dare to lower their interest rate lower than 0.3% even though they have the highest saving rate in the world.

Good luck America, you certainly need it to survive!

15.12.08

Make Yourself Big & Everything Will Be Fine

Amazingly, a lot of expert say yes to this and urge government to take action as fast as possible. According to them, Auto industry is too big too fail.

First of all, total worker in the auto industry is small relative to health care or real estate. Only 3% of American work in the auto industry.

Furthermore, even senate reject the bill of 34 billion loan, Bush Administration still want to use TARP money to save them.The 700 Billion TARP now only left 60 Billion and if Government loan 34 Billion to The big 3, that's mean only 26 Billion left and frankly 26 Billion is as useless as my toilet paper which again mean another big bill coming?

Don't think 34 billion loan will save them, it only ensure them to survive till March so they can get out with a restructuring plan. Does that mean they will need a much bigger loan March 2009?

GM is in talk with Chrysler to merge as a new company for 1 reason and 1 reason only: to make them big enough so government won't let them fall just like financial companies. For Chrysler case, it is even ridiculous. The Owner of Chrysler, Subaru said they don't want to help Chrysler so Subaru ask Chrysler to get help from Government. I mean if Chrysler still has hope of making a profitable business, I am sure Subaru will step in.

The reason they can't fail: too big. They are too big to fail. The same situation happened to Financial companies, Banks, IB and now auto company. Couple of months ago most Banks are into Merge and Acquisition. They merge just to make itself big enough. Bank of America bought Merrill Lynch after accessing ML balance sheet for a day. How can a company buy another company as big as ML after only reading its balance sheet for a day?

Tomorrow FOMC will decide interest rate and it is widely expected to be cut to zero or near zero. Furthermore, Federal Reserve also said they will gear up the printing press.

Anybody remember Zombie Companies and Zombie Banks from the Japanese in the 90's? Jim Rogers mention it many times on TV. In the 90's, Japanese Government won't let anybody fail and bailout everybody. As a result, Japan stock market today is 80% lower than in the 90's and still recovering from it.

However Japan is different as Japanese government is one of the biggest creditor in the world and Japanese work hard and save a lot. US is in exact opposite scenario.

So do you know why government won't save you and me? because we are not big enough. So next time when you make a bad decision, make sure you are big enough so that Paulson and Bernanke will answer you call.

10.12.08

Bottoming?

I have to say stock market performance around the world last week and this week amazed me. I don't think we have such a bear market rally before, so it could only mean a thing: bottoming?

Seriously, Hang Seng Index today closed at 15575, off the low of 11148. That's around 40% rebound off the low. Nikkei had a low of 6994 and closed today at 8660, a near 24% rebound off low. Kospi had a low of 892 and closed at 1145 today, a 28% rebound. FTSTI off the low of 1473 and closed at 1821 today, 24% off low. ASX off the low of 3201 and closed today at 3573, 12% rebound. Shanghai Composite had a low of 1665 and closed at 2079 today, a 25% jump.

For Eurozone stock market, FTSE had a low of 3665 and now trading at 4378, a 20% rebound. DAX had a low of 4014 andnow trading at 4797, a 20% rebound. CAC had a low of 2838 and now trading at 3307, a 17% jump. SMI had a low of 5034 and now trading at 5781, a 15% rebound.

Dow off the low of 7449 and now trading at 8751, 17% rebound off low. Nasdaq had a low of 1295 and now trading at 1551, a 20% rebound and finally S/P 500 had a low of 741 and now trading at 893, a 20% jump.

From the technical analysis point of view, every single stock market look good in every way. MACD, STO, RSI are pointed upward for every stock market listed here.

Besides, the rally we have now is far higher than any bear market rally we had in history. Most stock market have more than 20% rebound off their low. That's good enough to break any Fibonacci level.

Today we will have a congress vote on auto bailout which everyone knows the big three will win the vote. Another strong day coming?

However, we had this rebound out of nothing! No good news at all during this period of 20th of Nov til now (well if you smart enough to consider auto industry bailout or government stimulus package are good news, then there are two). Every economic data show we should not have a rally.

Plus, most rally is funded by government fund. We can clearly see in Japan, US, Hong Kong and Euro zone where stock market is lifted by derivative market. Derivative market shoot the moon with huge volume enable stock market to follow it and investor/trader start buying stocks.

Furthermore, major short covering activities also contribute to this rally.

We all heard about this crisis as the worst crisis since world war 2 or even Great Depression since we look at economic data and we all believe in Keynesian Economic Theory where Consumption is the biggest contributor to GDP*.

However if we look at economic system as a whole from Austrian School of Economic Theory, we can easily notice situation now is much worse than world war 2 or Great Depression. During that period of time, US dollar was pegged to gold(gold standard) and US is still the biggest creditor nation in this world. So situation back then is much better that way.

FYI, I write this not because I am a USA-hater or I have short the market. I am yet to take my profit on this rally. I just want to warn everyone that when everybody thinks we have the bottom and everything seems to get better, disaster is waiting to struck and make sure you prepare for that.

So do you still think we have a bottom in stock market? think twice!

*For those who are not familiar with Keynesian Economic theory, check it out at http://en.wikipedia.org/wiki/Keynesian_economics

and for those who are not familiar with Austrian School Economic theory, check it out at

http://en.wikipedia.org/wiki/Austrian_School

5.12.08

Real Petrol Price In US Is Officially Lower Than Malaysia (Oil Producer Country)

As we know,

1 US gallon = 3.78541178 litre.

Petrol Prices in Malaysia (Oil Producer Country) are Rm1.90/litre for RON97 and RM 1.80 for RON92. That's make a average of Rm1.85/litre.According to yahoo finance, latest Rm/$ = 3.6400

So petro prices in Malaysia in $/gallon term is

(RM 1.85 X 3.78541178)/3.64

= around $1.924/gallon which is more than 10 cents per gallon higher than petrol prices in US.

That's amazing as US is much more developed country with much higher money supply. Yes US is also a country with oil company such as Exxon Mobil, Chevron and so, but consider US standard of living compared to Malaysia, petrol price should be much lower in Malaysia.

Maybe one day all Malaysian will have to drive to neighbor country just to get reasonable priced petrol.

FYI, RON 98 price in Singapore is S$1.67/litre, RON 95 is S$1.596/litre and RON 92 is S$1.563

4.12.08

It's Matthias Chang, Again.

Matthias Chang,18 November 2008

"Let´s put some money in our mouths. In the past I have challenged those who disagreed with me, that if they can prove me wrong, I would> gladly pay them a RM5,000 cash reward. There were no takers. None could prove me wrong!

In the past few days, the mass media have gone out of the way to interview politicians and the Governor of Bank Negara to project a rosy picture that somehow our economy will overcome the severe pain and disruption from the on-going global financial tsunami.

I am willing to take on anyone from the Badawi regime and Bank Negara that by H1 of 2009, the KLCI will drop below 700. If I am wrong in my analysis, I will pay the first five individuals from the said Badawi regime and or Bank Negara the sum of RM5,000. These five individuals must within a week register at my website that they are willing to take me on in this challenge.

They have to provide their full name and address in accordance with their NRIC/MyKad and their designation.

If they lose to me, they must pay me the same amount!

Fellow citizens, don´t listen to the Badawi regime´s fairy tales. Prepare for the worst and the worst is yet to come. You owe it to your family. The best way to save our family and our country is to be prepared for all eventualities. We must tighten our belts, save for the stormy days that will surely come and not spend, spend as advocated by the Badawi regime´s ministers.

Use common sense. What do you tell your children as responsible parents when the family is going through hard times - spend, spend, spend or be thrifty, thrifty, thrifty?

Remember the flight safety rules when flying - when the oxygen mask falls from the overhead compartment, you are to wear the mask first before attending to your children. If you cannot save yourself, you are not in a position to save anyone. This is a fundamental principle of survival for everyone when a plane is about to crash!

Apply the same principle to economic woes and we will all be saved.

Here are my warnings for 2009:

By 2nd Half of next year, the automobile industry will go into a tailspin and suffer massive losses.

By 2nd Half of next year, credit card debts will soar, credit limits will be drastically reduced (worse than 1997/1998) and interest rates> on outstanding will increase sharply. It is already happening!

By 2nd Half of next year, shipping rates will drop drastically and this is also happening. Our ports and shipping companies will suffer.

By 2nd Half of next year, our housing market bubble will burst notwithstanding all the stimulus and pump-priming. Arab investors will not be coming. Dubai and Abu Dhabi is already in a financial / property gridlock! Why would they come here when they have to save their own asses?

By 2nd Half of next year, our exporters will be in tears, when Letters of Credit (L/Cs) will not be honoured and inventory stacks up at ports and in factory premises. Chinese exporters are already stipulating what LCs from which global banks will only be accepted.

By 2nd Half of next year, FELDA settlers will also be in tears. Having spent their windfall early this year (because of Badawi regime´s false optimism), their savings will be down and they will bleed.

By the 3rd Quarter of next year, corporate NPLs will shoot up! Relaxing mark-to-market rules will not help.

Malaysia will have a huge immigration problem when these hardworking people are thrown out of work and have to compete with the swelling ranks of Malaysian unemployed..

In the meantime capital outflows will continue.

Let´s see whether the statement that Malaysia has more than enough reserves (since according to Bank Negara, we need only have US$30 to US$40 billion reserves) will provide sufficient confidence to foreign investors to continue to invest in Malaysia ..

You can call the above observations - rubbish, pessimism, gloom and doom etc. but that won´t change reality.

Pause and think. In my previous warnings and alerts, I have stated that by the latest - the 1st quarter of 2009, things will get ugly and scary!

If I am not right, why did the leaders of the just concluded G-20 summit in Washington , in their so-called "Action Plan" stipulated that their policies, remedies etc. must be implemented by the end of the 1st Quarter 2009?

My articles were all written BEFORE THE SUMMIT and obviously I have no control over the leaders of G-20.

So ask yourself -"Why Oh Why Must the First Action Plan Be Implemented by the First Quarter of 2009?

This is only the first tentative steps by the G-20 leaders and there is no guarantee that the measures will work. The original Bretton Woods initiatives took almost two years to be formalised and put to work. There is no magic wand to be wielded by the leaders for instant cure. It will be a long hard grind. In the meantime, more shits will hit the ceiling fan. That is a given!

I hope the Badawi Regime and Bank Negara are not accusing the G- 20 leaders and Obama´s financial and economic advisers as being pessimists!

You be the judge!"

Highest Paid President & Prime Minister

taken their toll on the common man. Presidents, Prime Ministers are no

exception. Most of the heads have cut down on their salaries or are planning

to do so in the near future. Lets take a look at what the heads of top nations

are earning

Lee Hsien Loong, Singapore

(Country GDP: $235.6 billion - 2008)

Politicians in Singapore are amongst the most highly paid government officials in

the world. Lee Hsien Loong, Prime Minister of Singapore earns five times more

than the American President. Lee Hsien Loong takes an annual salary of $2.46

million.

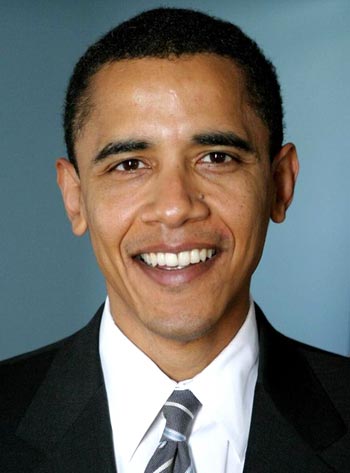

Barack Obama, USA

(Country GDP: $13.81 trillion - 2007)

Second on the list is the President of the biggest economy of the world with a

GDP of $13.81 trillion (2007). President Elect, Barack Obama will be getting

an annual salary of $400,000 when he joins office next year.

Kevin Rudd, Australia

(Country GDP: $773 billion - 2007)

Third on the list is the Australian Prime Minister, Kevin Rudd with an annual

salary of $330,300.

Angela Merkel, Germany

(Country GDP: $2.585 trillion - 2006)

The first lady chancellor of Germany, Angela Merkel receives an annual salary

of € 242,000 (€ 22000 bonus included) ~ $ 307,340.

Nicolas Sarkozy, France

(Country GDP: $1.871 trillion - 2006)

The French President, Nicolas Sarkozy gets an annual salary of

€ 240,000 ~ $ 304,800. This is after he doubled his salary earlier this year.

Stephen Harper, Canada

(Country GDP: $1.274 trillion - 2007)

Stephen Harper, Prime Minister of the seventh largest economy of the world,

Canada recieves an annual salary of $280,000.

Gordon Brown, UK

(Country GDP: $2.772 trillion - 2007)

Gordon Brown, Prime Minister of the second biggest economy in Europe

and fifth largest in the world receives an annual salary of € 187611

~ $238,266.

Vladimir Putin, Russia

(Country GDP: $2.076 trillion -2007)

The Russian Prime Minister recieve an annual salary of $81,190, which

is significantly less than his counterparts.

Wonder why Lee get such a huge salary (>5x more than everybody else).

Temasik? PAP? No strong opposition party? Violence? Use your imagination...

1.12.08

Basic Theory Of Money In Economics And US Economy Today.

Economics and problem that US face today.

29.11.08

Most Ridiculous Thing Ever

This is a clips of Peter Schiff answering questions about Barack Obama with two stupid CNBC host.

Near the end of this video, the lady actually said the most ridiculous I have ever heard in my life:

Gold has no value!!!!!

Can you believe a person in this world thinks gold has no value? yes you can now since she is working in CNBC now

28.11.08

Should Malaysia Introduce Short Selling?

So what is the benefit of short selling?

short-selling help adjust price to the correct value. The efficient market hypothesis is based on the assumption (as well as many other assumptions) that short-selling is possible. While I don't believe in the efficient market hypothesis for other reasons (that is, many of those other assumptions are wrong), it is correct in noting that the ability to sell short helps move markets closer to that ideal.

If a certain stock (or other asset) is overvalued, yet the people who realize this have already gotten out of the stock, then the way for them to correct this overvaluation is to sell the stock short. That way, these informed investors can bring the price closer to its fair value. But if short-selling is banned, this kind of adjustment can't take place.

That mean we won't have crazy stock price trade at more than 100x PE and still going up everyday. Somebody will stop the market maker from doing it. In Malaysia case, Remember Iris?

Another aspect of this is that people who for some reason believe a certain stock is too cheap can use their money or even borrowed money to buy stocks they think are too cheap. Yet people who come to the conclusion that a certain stock is overvalued can't do anything about it unless they already owned the stock in the absence of short-selling. And even those that already owned the stock are limited to their stocks, while people bullish about the stock could possibly borrow to buy more of it. This creates an asymmetric situation where people bullish about a stock will have much greater influence than those that are bearish about it, which increases the risk that some stocks will be over-valued.

Like I said before, short selling never push the market lower because short selling activity create buying activity as short seller need to cover their position. Plus, if a company is doing good, no body will allowed short seller to destroy it's price. Bargain hunter will rush in. In other word, short selling help adjust a stock to its fair value price. If Citigroup is traded at 7.05, that's because it only worth 7.05 or less if government didn't guarantee their 300 billion bad debt.

Besides that, stock market that banned short selling generally have higher PE ratio than stock market that allowed short selling simply because people who think market is overvalued can't sell any stock without buying it first. However if they think market is overvalued, why should they buy in the first place. So only people that buy is those people who bullish about the market and won't sell it anytime soon. This create a situation we called a bubble. it make the stock market irrelevant and highly increase chances of financial crisis. So in longer term, short selling actually prevent those thing.

Overall I think short selling should allowed in all stock market including Malaysia as short selling help price adjust faster to its fair value. If a stock is worth 10 Ringgit, let the market force adjust it to 10 ringgit. Don't interrupt the free market and only allow price to go higher.

27.11.08

Clear All Your Position!

Ready To Take Your Profit?

Although stock market around the world rebound hard(Dow hike more than 1000 point in 4 days), some of my stocks are doing even better so i will review it and see what happen.

2899 HK Zijin Mining.

Its price was 2.24 when i recommended it and yesterday closing was 2.59.(0.35/15.6%). Keep it.

2600 HK Chalco

Our second largest mining company in the world is doing fine as well. Its price was 2.90 when i recommended it and yesterday closing was 3.19 (0.29/10%). Look for a good price to exit trade soon.

0016 HK SHK Prop.

Its price was 52 when i recommended it and yesterday closing was 57.25 (5.25/10%). Continue the hike!

BHP ASX BHP Biliton.

Its price was 21.90 when i recommended it and now it's trading at 28.58 (6.68/30%). Rio Tinto really help it but you should get yourself out of this counter now and enjoy the profit.

CSCO NYSE Cisco.

Its price was 15.17 when i recommended it and yesterday closing was 16.39 (1.22/8%). Continue.

TSM NYSE Taiwan Semiconductor

Its price was 6.51 when i recommended it and yesterday closing was 7.19 (0.68/10.5%). Ride the hike.

I admit if you bought other counter such as C you will have higher return but all my recommendation is very safe and secure. You can choose between high risk/high return or moderate risk/moderate return. I choose the later.

25.11.08

A Man Named America

America came from a poor family. He was bullied by other kid when he was in his youth. His friend, Spain and Britain always bullied him and he lived in fear. Those friend took away his money and freedom.

However he didn't want that to happen so thanks to his brave heart and determination, he fought back. Eventually he succeed. Spain and Britain never bullied him anymore.

So he started to work hard since he knew the only man that can help him is none other than himself. He worked his ass off as an agriculture worker and started his own farm as he knew everybody need to eat.

He then earned a lot of money from agriculture industry. However he got a new idea. He thought agriculture is good but the earning from it is very thin. Soon, he started his manufacturing work and began to produce manufacturing goods. He opened his own factory and enhance his production line. His products were sold around the world and everybody seems to like it. He became the richest man in the world. He opened more factory and produced variety of goods to meet the demand of everyone.

Then he made the single biggest mistake of his life. He appointed his friend, Federal Reserve as his financial consultant and give him the full control over his account. At the beginning, Federal Reserve worked well so America trusted him even more and give him more power.

Then disaster struck. A new gangster group named axis started bully everyone around America including his old foe, Britain. This gangster group, led by a man called Germany wanted to conquer the whole neighborhood. So Britain came and asked America for help since America is very rich and powerful. Luckily though America had a very smart friend called Albert Einstein. Einstein help America Defeated Axis. Britain and America finally became friend again.

After that America began control the neighborhood using his wealth superiority. He didn't think manufacturing industry is good enough so he began to swift his business to services industry. He got a evil idea: since he is the richest person around and everybody trust him, he can make his own money more powerful and use that to get what ever he want. He began to ask his financial adviser, Federal Reserve to print more money and use it to exchange goods with other people. What ever he want he can just print more money and get it. Not only that, he began to use his own saving from his previous agriculture work and manufacturing work to exchange more goods from others and he live in a very comfortable life. When his printing machine broke down, he borrowed money from others and continue his colorful live and buy what ever he want.

Finally now he is broke. He has no more saving and he own a lot of money to others. His only way of getting more money is by printing it. However he refuse to go back to basic and start all over again, instead he continue to use his printing machine and print more money. He still think his money worth as much as before but that's not true. Soon, other people will realize his money is as worthless as a piece of paper and they won't exchange goods with him. He got no farm, no factory and he doesn't want to open one as he still think services industry is the best. Worse, he still trusted his financial adviser, Federal Reserve and still give him all the power to destroy his life.

What do you think is the ending of this man called America? He survive the problem? How? By printing more money?

He got into his problem now because he printed a lot of money and to solve it is print more money?

Even if he does survive the problem, what's next? he will reopen his farm and factory or he will continue the way of living just like before the problem?

24.11.08

My Very First "Buy" Recommendation For You All.

2899.HK Zijin Mining.(p=2.24)

I'm sure everybody knows what happen to gold last friday. So try trade the counter and tale your profit before end of the day.

2600.HK Chalco.(p=2.90)

Everybody knows this is the worst performing HSI component counter of them all. It's time for it to roll. Trade it for few days but remember timing is essential.

0016 HK SHK Property. (p=52)

It's now at 52 but once it was a >150 dollar counter. It's "mother" 0086 SHK trading at less than 3X PE and it's the most valuable and certainly best developer in HK. Need i say more?

BHP Asx (p=21.90)

world largest mining company got hammered hard since few months ago and now trading at around 22.22. Attrative enough?

CSCO NYSE (p=15.17)

We all know last week CSCO was hammered only because bad report by some so-called "expert". Do the opposite thing!

TSM, NYSE (p=6.51)

Taiwan Semiconductor rally more than 11% last friday in US and traded at 6.47. Wait for better price and go for it. 6.30 maybe a great entry price. Trade it either in Taiwan or US.

That's all for now. I will do my trading now and i hope we'll have a profitable trading day.

20.11.08

Long Way To Go

Dow close below 8k point. First time in 5 years and S/P 500 just 6.58 point above 800 level. 5 Years ago, Federal Reserve led by Alan Greenspan did a historical thing which is lowered the interest rate to 1%. So in other word, the business cycle only goes around once. Dow back to their 2003 level and interest rate back to their 2003 level which is 1%. That mean if you start buying stock at 2003, theoretically you are break even now. So where are the credit crisis?

That's why I said we still have long way to go. I think we will have this type of stock market at least until President Obama next Presidential election. Based on so many bad economy data, do you think Dow reach it's bottom only 42-43% of it's high? Not even 50% off for the biggest economic crisis? you definitely underestimate the power of this credit crisis and forget who is in control, stock market or economy as a whole?

Like I said many times, stock market crash did not and will never contribute to any crisis, recession or depression. It's the crisis, recession or depression that contribute to stock market crash.

Yesterday i read a very interesting article on when our stock market/ economy will recover and it's from a famous financial website. It said in best case scenario, World economy and stock market will reach its bottom end of this year and start recover next year. However the worst case scenario, stock market/ economic will reach its bottom on second quarter of 2009 and start recover on third quarter 2009.

Well, How can anybody in this world know when economy will recover? economy/ stock market bottoming on second quarter next year is the worst scenario? Give me a break.

Another important topic: Fair value vs Stabilizing. US official always try to stabilize price of US assets. They try to stabilize house price, share price, bond price etc. Well, the true fact is that those assets are overpriced then and overpriced now. What they did is not stabilizing but preventing those assets from dropping back to it's fair value. Every analyst in this world said stock market all over the world is cheap now but i think it's still expensive. It's still way above it's fair value.

If a stock's fair value is 1.00 and now trading at 2.50. Yes you can still make profit from it because of greater fool or turtle rules where high will go higher. However if that stock drop to 1.50 and you think it's cheap, you have a big chance of losing another 50 cents. No matter how hard government or investor try to prevent it from going to 1.00, eventually free market will prevail and normally if anybody try to fight free market, it will teach you a lesson and give you 0.75.

Same for US now, the harder US official try to prevent recession and stock market plunge, the worse it will create.

Trade Carefully and remember cash and risk management is king.

18.11.08

Why You Should Ignore "BUY" Recommendation By Investment Banks

The reason they recommend a stock is very ridiculous. The method they use to determine a cheap stock is outdated. Most of the time they will used unsuitable accounting ratio to convince their customer such as Price/Earning Ratio and Price to book ratio. All of these ratio is useless and i will tell you why:

The single most commonly used ratio is P/E ratio. Investment banks will make a "buy" call on a stock when its PE ratio is below 10 or so. PE ratio is useless because it used previous earning level versus current price level which is completely misleading. Current and future earning level might not be as good as before. Just look at all the financials in NYSE earlier this year. They all trade at below 10x PE and look at them now.

Besides, PE ratio determine the outlook of future performance of a company. If a company trading at less than 5x PE, investor think its future is really cloudy. Forget about hidden treasure and greatest story never told, there are no good stock with low PE ratio nowadays. If a company is good, its price is low and its PE is low, i'm sure Mr Buffett, Mr Soros and all the big gun have spotted it.

Price to Book ratio is also useless as the book value, as it is conventionally computed, does not include intangible assets such as intellectual property and brands. Thus the book-value or net tangible assets may not be an appropriate measure for many firms.

Target price is another tool by investment banks to generate revenue. Target price is absolutely useless as nobody in this world can target the price of a stock 12 months from now. Target price real intention is to make investor greedy and buy that stock. I've seen target price for some company set as high as 200% from current price. If a stock can go that high in the next 12 months, why its price traded at current low level? and if that company secure any big project or goes for restructuring, insider of that company should have already know and start buying so its price won't trade at its current price level.

Big Investment Banks such as Goldman Sachs and Morgan Stanley recommendation may have a short term impact but in the medium-long term, company fundamental is what counts. Eg. Goldman Sachs was traded at around 210 January this year and every investment bank recommended a buy for this company. I've seen target price of 250-485 by year end. It's PE is low, It's PB is low, biggest investment bank in the world.......Everything looks great. Well, now it's trade at 62.49 (plunge more than 65%).

So do not believe any recommendation by any investment banks especially a "buy" call with ridiculous high target price. Evaluate and study a company yourself and look at it past performance and future activity. Compare it to other company in the same sector. There are no free lunch in this world so you have to work hard to succeed.

Good luck!

17.11.08

Amzing Similarity Between The Movie "SAW" and US Economy

Although John Kramer is dead, his game is continuing with his new apprentice and again, those traps are so creative you simply have to watch it.

After watching it, i found a similarity between "saw" and US economy. In "saw", usually the victim who did something wrong in the past(murder, rape etc.) will be put in a trap and the victim has a choice: lose part of his/her body that did the wrong thing or lose his/her life.

US economy now is also been put in a giant trap of credit crisis and it has a choice to make: lose part of it's body(financial companies with bad management, bad automaker, low quality management companies) or lose it's life.

As in the movie, most of jigsaw's victim choose to die, i hope US will choose the other

15.11.08

How To Predict Stock Market Movement Correctly

Yesterday one of my friend ask me this question:

How to predict the stock market movement correctly.

Well, I can't say i'm an expert in this but i got some thought about it so i would like to share on you.

First of all, in short term, stock market like other markets is irrational and full of emotional trade. Hedge Fund Dominate the short term market and try to create different scenario or emotion such as greed, fear and hope. Only way to win is to guest what will hedge fund do. There are very little technical analysis knowledge involved, very little basis knowledge of stock market involved.

Example, on Oct. 28, 2008, S/P 500 and Dow Jump more than 10% without any good news at all. Some call it bargain hunting or technical rebound or short seller covering position but none of that's true simply because those reason won't make stock market jump 10% in 1 day. Only way a stock market anywhere on planet can do that is some fund manager dump money in without looking at it.

Another example: yesterday Dow and S/P 500 jump 7% and again we see the word such as bargain hunting. For me, bargain hunting stop when Dow hike 3-4%. The rest is irrational.

For Long term however, we need something more than guesting to win. Here are what i think from my experience:

50% economic knowledge. Have you wonder why some Analyst can predict market so accurately? Some may say they got lucky. Other even say market is only up or down so it's a 50% chance of getting right. However, to be as accurate as Jim Rogers, Marc Faber or Peter Schiff you certainly need more than luck. They can predict the stock market so accurately because they look at stock market as an entity of whole economic activity. Yes, you can have a rally after a bad economy news but in the long term, everything will unfold and stock market will head towards the place it should go.

40% Technical Analysis Knowledge. Yes, in long term trading, you still need technical analysis knowledge to predicts the movement of stock market to avoid big technical rebound that can't be explained by economic term. Eg. US dollar has rally for few months now and by looking from economic point of view it simply does not make sence. However with technical analysis knowledge, you can easily see how bad US dollar is oversold and how bad other liquid assets are overbought last year so deleveraging process could take months.

10% luck or ability to control emotion. You still need luck since no body knows what bad thing can happen ad yes, long term trading still involve emotion but rather small compare to long term trading.

Here is just my point of view from my experience in stock market. You still need to develop your own winning formula to beat the market. Like i said there are no person that's always win and no person that's always lose but you certainly can do yourself a favor and avoid losing all your money just simply because lack of winning formula.

14.11.08

Finally President Bush Said Something Right

Bush defends capitalism on eve of economic summit

By BEN FELLER – 1 hour ago

NEW YORK (AP) — President George W. Bush fervently defended U.S.-style free enterprise Thursday as the cure for the world's financial chaos, not the cause. He warned foreign leaders ahead of a weekend summit not to crush global growth with restrictive new rules.

"We must recognize that government intervention is not a cure-all," Bush said from Wall Street, setting his own tone for the two-day meeting that begins Friday in Washington seeking solutions to the economic crisis that has spread around the world.

"Our aim should not be more government," he told the business executives. "It should be smarter government."

The president acknowledged that governments share the blame for the severe economic troubles that have hit banks, homes and whole countries.

He spelled out his prescription, which includes tougher accounting rules and more modern international financial institutions. But he stopped short of the tighter oversight and regulation that European leaders want. All his ideas came with a warning: Don't disturb capitalism.

"In the wake of the financial crisis, voices from the left and right are equating the free enterprise system with greed, exploitation and failure," Bush said.

"It is true that this crisis included failures, by leaders and borrowers, by financial firms, by governments and independent regulators," Bush said. "But the crisis was not a failure of the free market system. And the answer is not to try to reinvent that system."

That warning about the dangers of too much government intervention came not long after he championed the biggest bailout in U.S. history: a $700 billion taxpayer-funded plan to rescue the financial industry. His government has also signed off on costly rescues for housing, insurance and other financial institutions.

The U.S. wields enormous clout in any global response to the economic crisis, and Bush is host for the weekend gathering, bringing together heads of state from the world's biggest economies as well as emerging nations. It is intended to be the first in a series.

But Bush's personal influence is waning.

In about two months, Democrat Barack Obama will take over as president. Though the president-elect does not plan to attend this summit, he has authorized former Iowa Rep. Jim Leach and former Secretary of State Madeleine Albright to represent him. Obama's transition team says they will primarily be listeners on the periphery of the meetings.

The world leaders come to Washington with their own ideas for change. French President Nicolas Sarkozy, British Prime Minister Gordon Brown and others are advocating a broader overhaul of financial regulations than Bush wants. The Europeans also want a pledge for concrete changes in just 100 days.

The stated goal for this weekend is to examine the causes of the crisis and begin mapping out principles for a response.

But Britain's Brown, on his way to the summit, declared, "There is a need for urgency."

It was fitting that Bush's argument against regulatory overreach was delivered not in Washington but on Wall Street. His speech venue was venerable Federal Hall, home to the first Congress and within shouting distance of the New York Stock Exchange.

There was freshly sobering news on the U.S. economy: The number of newly laid-off people seeking unemployment benefits jumped to a level not seen since just after the Sept. 11, 2001, terrorist attacks. Still the Dow Jones industrial average surged 553 points at the end of the trading day.

Some of Bush's admonitions raised questions about his own past actions, including last month's big bailout law.

Also, he is one of those voices from the right who railed about greed, saying in an unguarded moment in July that Wall Street "got drunk and now it's got a hangover."

On Thursday, he defended his administration against charges from some leaders that insufficient oversight and regulation in the U.S. contributed to — even caused — the mess by failing to raise alarms. Obama is among those who say no one was minding the people's business as the housing market plunged, credit markets ground to a halt and the broader financial system went into distress.

White House aides play down Bush's differences with other nations, saying the leaders have much in common, as evidenced by the gathering itself.

Bush's list of possible areas for agreement include:

_Bolstering accounting rules for stocks, bonds and other investments so investors have a clearer sense of the true value of what they buy.

_Requiring "credit default swaps" — a type of corporate debt insurance — to be processed through a central clearinghouse. That would help provide crucial information on the parties involved in these complex, unregulated products.

_Taking a fresh look at rules aimed at preventing fraud and manipulation in trading of stocks and other securities.

_Better coordinating financial regulations among countries.

_Giving more countries voting power at the International Monetary Fund and the World Bank.

Besides the United States, the countries represented at the White House dinner Friday and meetings on Saturday will be Argentina, Australia, Brazil, Britain, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Mexico, Russia, Saudi Arabia, South Africa, South Korea and Turkey. Those countries and the European Union make up the so-called G-20.

Australian Prime Minister Kevin Rudd said before he left for Washington that he would raise with fellow leaders his view that a system in which executives of financial firms are rewarded for maximizing risk "cannot be sustained." He said, "That's just dumb, it's wrong and it's bad."

Trade union leaders from participating countries planned to join AFL-CIO leaders Friday in meetings with several foreign heads of state, including Brazilian President Luiz Inacio Lula da Silva, and with IMF Managing Director Dominique Strauss-Kahn and World Bank President Robert Zoellick.

The labor leaders are calling for re-regulation of global financial markets, an internationally coordinated fiscal stimulus and balanced economic growth to address income inequality.

AP writers Jeannine Aversa and Jim Kuhnhenn contributed to this story from Washington.

Source: AP

13.11.08

12.11.08

Make Yourself Big & Everything Will Be Fine

Amazingly, a lot of expert say yes to this and urge government to take action as fast as possible. According to them, Auto industry is too big too fail.

First of all, total worker in the auto industry is small relative to health care or real estate. Only 3% of American work in the auto industry.

Furthermore, even senate reject the bill of 34 billion loan, Bush Administration still want to use TARP money to save them.The 700 Billion TARP now only left 60 Billion and if Government loan 34 Billion to The big 3, that's mean only 26 Billion left and frankly 26 Billion is as useless as my toilet paper which again mean another big bill coming?

Don't think 34 billion loan will save them, it only ensure them to survive till March so they can get out with a restructuring plan. Does that mean they will need a much bigger loan March 2009?

GM is in talk with Chrysler to merge as a new company for 1 reason and 1 reason only: to make them big enough so government won't let them fall just like financial companies. For Chrysler case, it is even ridiculous. The Owner of Chrysler, Subaru said they don't want to help Chrysler so Subaru ask Chrysler to get help from Government. I mean if Chrysler still has hope of making a profitable business, I am sure Subaru will step in.

The reason they can't fail: too big. They are too big to fail. The same situation happened to Financial companies, Banks, IB and now auto company. Couple of months ago most Banks are into Merge and Acquisition. They merge just to make itself big enough. Bank of America bought Merrill Lynch after accessing ML balance sheet for a day. How can a company buy another company as big as ML after only reading its balance sheet for a day?

Tomorrow FOMC will decide interest rate and it is widely expected to be cut to zero or near zero. Furthermore, Federal Reserve also said they will gear up the printing press.

Anybody remember Zombie Companies and Zombie Banks from the Japanese in the 90's? Jim Rogers mention it many times on TV. In the 90's, Japanese Government won't let anybody fail and bailout everybody. As a result, Japan stock market today is 80% lower than in the 90's and still recovering from it.

However Japan is different as Japanese government is one of the biggest creditor in the world and Japanese work hard and save a lot. US is in exact opposite scenario.

So do you know why government won't save you and me? because we are not big enough. So next time when you make a bad decision, make sure you are big enough so that Paulson and Bernanke will answer you call.

11.11.08

When Will US Economy Recover?

August last year(17/08/2007) when sub prime crisis started, many journalists and traders said it is just a small problem for the mighty US economy. If you watch CNBC regularly then you will notice that Erin Burnett, Jim Cramer and other CNBC people said about sub prime problem is a opportunity to buy!

Then came October last year when Dow at all time high of around 14100, everybody is talking about economic nirvana, greatest story never told and super bull stampede!

Then disaster happened on November and December. Stock market all over the world start dropping and again, many "expert" on CNBC and Bloomberg shouted that this is the life time opportunity to grab some under priced stock. Somehow most of them liked financial stocks.

Early this year again stock market tumbled and again they said worst is over......

So more than 1 year after sub prime crisis, people started to realize this is no regular bubble. This bubble is so big and it's probably the biggest we ever had.

Back to the 1 million dollar question, now everybody on CNBC and Bloomberg again forecast we will have bottom on end of next year or early 2010 and some folks actually believe them. They have been wrong for a year and if you still believe them, you are in real trouble.

I have read many Analyst report, watch CNBC and Bloomberg all the time and only agree to 3 people: Jim Rogers, Peter Schiff and Marc Faber because they have the guts to tell you the truth.

What if the answer of that question is US economy can't and won't recover?

Throughout last century world economy never had a crisis that can't recover and we all assume that this crisis is just like others. It's almost like we never had bad illness and suddenly we have a cool and we assume we will heal very soon. However that cool maybe is the early symptom of a AIDS and other disease that gonna kill us?

In other word, US economy may recover and may not.

So the real question you should ask yourself is this: WILL US ECONOMY RECOVER?

9.11.08

Our F**king Leader

All the so-called "smart" leaders of the world have unlimited amount of meeting and they always have the conclusion of not enough credit and interest rate is not low enough.

I remember Ben Bernanke said one thing in front of US Congress and what he meant is that world economy is in crisis and banks are not functioning well. As a result people who need money can't get their money and economy activity will be stopped.

However to answer Bernanke stupid statement, I remember Peter Schiff said a thing: what Federal Reserve and world central banks do is just to ensure people who need money get theirs but those money is worthless because of hyperinflation after this.

In other word, what central banks do to solve the problem actually create more problem and the problem become bigger and bigger.

What we need to do is: DO NOTHING. There are a lot of good fundamental banks that still can provide loan to those who survive. Don't fix the price, let the price adjusted by invinsible hand. Free market mechanism never fail and it never will.

Yesterday, world leader gathered once again to have a meeting about our economic situation. Let me teach them what they should talk about:

Economy is a business cycle. There are long term, medium term and short term business cycle. Business cycle mean we will have UPs and DOWNs and it's perfectly fine.

However, central banks around the world just want the UPs of the business cycle and try to prevent the DOWNs so they try to fix the price. Once they did it, yes, we will have more UPs and less DOWNs for a short term period but that is what we call a bubble.Bubble mean it's empty in the middle and may burst any time. It is phony and not real.

Every single economic crisis existed is created caused by central banks. They try to fix the price and try to prevent DOWNs in the business cycle that we should have. From the Great Depression 1929 to 1979 to Japan in 1990's to asia financial crisis in 1997 to dot-com to credit crisis now, they all are caused by central banks.

However, i think stock market will rally tomorrow due to short term effect of central banks action. As i say before stock market is irrelevent in short term. People can't resist to buy stock because everything looks good and credit is easy to get. However in the long term, please don't touch stock unless your are a short seller

8.11.08

Buffett Is The Next US Treasury Secretary?

Now that is good news as we know Henry Paulson is one of the lousiest ever Treasury Secretary of all human history. Getting rid of him will surely bring some "change we can believe in".

Everybody talking about Warren Buffett, chairman and CEO of Berkshire Hathaway inc, as one of the hottest candidate for that position. Warren Buffett is a legendary investor. His life is a epic journey every investor should know. Every word that he said should be remembered by investors arould the world. He helped countless investor became millionaire and he is the world's richest man.

Besides that, he is a modest man. He live a simple life, driving a low cost car and staying in a medium-cost house.

However, as the head of the department of Treasury, The Secretary of the Treasury is the principal economic advisor to the President and plays a critical role in policy-making by bringing an economic and government financial policy perspective to issues facing the government. The Secretary is responsible for formulating and recommending domestic and international financial, economic, and tax policy, participating in the formulation of broad fiscal policies that have general significance for the economy, and managing the public debt. The Secretary oversees the activities of the Department in carrying out its major law enforcement responsibilities; in serving as the financial agent for the United States Government; and in manufacturing coins and currency.

In other word, The Secretary of the Treasury is the financial advisor for US government and in charge of economic policy(micro and macro) of US government. That's ironic because warren buffett is not famous of economic studies. Warren Buffett is a investor. He is not a economic expert that know how to ensure stability of a economy. Instead, he more comcern which type of investment will give him maximum return.

In other word he is a wall street guy and not main street guy. I bet he know much more about stock market that economic. However some time what good for stock market may not be good for economy and vice versa. So for me who should become next US secretary of Treasury?

A nobel prize winner may be a good candidate as he or she sure know about economy more than Buffett. If we can't find one then a prefessor in a famous University such as MIT, Harvard may be a good idea. At least his or her main focus is economy itself and not wall street.

The candidate must also know the importance of free market mechanism. Free market is the only tool that help US to become the most powerful nation in the world. It correcting government failure every single time. Without it, US uis already died in 1929 or 1970's. Every time US government agencies did something wrong, free market gave a warning and correct it. However this time government don't care about free market warning and ignore it. Let's see what is the consequences of that...

Anyway that's my point. Henry Paulson did such a lousy job because his main focus is wall street and ignore main street. He take care of the wealthy people and ignore the lower-medium class people. He helped chairman of big companies but he never help a poor citizen. Let us hope next US Secretary of Treasury won't be that.

6.11.08

Changes That We Can Really Believe In

Barack Obama slogan is "change we can believe in" which I believe is the main reason he won except for the fact that his opponent is too weak. However, as US economy are on the edge of "turbulence", what changes Obama gonna make?

Neither Barack Obama or John McCain said before how they gonna get the money needed to fund the 700 billion bail out and now as bail out episode 2 is on the way, we should seriously ask the man where he will get his money? Well at least we know he could blew up >500 million to become who he is now...

As a person studied economics for years, I really think Obama knows nothing about economics and from the statement he made before about US economy, I pretty sure he gonna destroy the US economy.

So I think yesterday is a sad day for US economy. Although I think John McCain would not does any good for US economy, at least he won't destroy it further. Now US senate and House of Representative dominated by democrats, it's easy for them to pass another bail out plan which will definitely kill it.

As a trader, I really hope Obama can make changes that not only we can believe in, but changes that work but I have serious doubt on President Obama. Forget terrorism, forget Iraq, forget war, forget healthcare, education, senior citizen pension. Without a strong fundamental in economy, nothing will work.

Let the free market and invinsible hand work it out. Changes we really need is no intevention. Let us hope Obama believe in free market and make a changes that we can really believe in.

1.11.08

Must Watch Video From Peter Schiff at Early 2007

This Video was on air at around early 2007.

What make this video great is so many so-called "expert" laughed at Peter Schiff when he talked and now you know who's laughing.

Finally Jim Cramer Talk Something Wise and I Totally Agree

Watch this as Jim Cramer explain why market moved higher this week and i am totally agree with him.

Although i am no jim cramer fan, he is right this time.

Remember 3 days ago Dow surged 900 point or 12%? Here's the answer.

However my "agreement" to Jim Cramer stop when he answer phone call!

31.10.08

If I Am The Next US President......

I am thinking if I am the next US president, what I gonna do?

First of all, I will fire Ben Bernanke. He is certainly one of the worst central banker in the world. I can't think of anybody that misuse monetary policy worse than him. He claims that he is the expert of Great Depression but he really knows nothing about GD. Get rid of him fast! I suggest replace him with Jim Rogers.

Well, I will fire Henry Paulson as well. Like Bernanke, he is also one of the worst in his position. Department of treasury suppose take care of fiscal policy and government budget. However he let US economy in trillions of debt and crazy budget deficit. The worst part is he still think he is right and will continue his policy. I think Marc Faber or Peter Schiff is the right man for this.

Next, I will raise interest rate to attract savings and preserve the value of US dollar. With saving from US citizen, US will be able to pay back some debt to foreign country. Inflated asset prices will come down to its reasonable level.

Fire CEO of trouble banks. Trouble banks are in trouble because of imcompetent CEO. They should be fired and replaced by qualify CEO.

So many more tasks to go. However I know i am not the next US president and I am pretty sure next US president won't do the same as above so still, GoodBye USA!

30.10.08

Good Bye USA!

29.10.08

Should Fed Cut The Key Rate To Zero?

"Should Fed Cut The Key Rate To Zero"

Even more amazing is a so-called "expert" actually say yes!!!

Now clearly he missed his Economic classes and don't know what's interest rate and it's effect to the macro economy.

Well, even the famous Albert Einstein knew some economics and said this:

"compound interest is the most powerful thing in the universe"

HOW CAN INTEREST RATE CUT TO ZERO IS GOOD?

If interest rate cut to zero, central bank will lose control to the monetary policy. Imagine if you can borrow money without interest, you will borrow as much as you can.

Banks will do the same. They will borrow more than what they need and spend it on other toxic commercial paper or loan it to everybody else with or without a job.

The problem is we already know it is the bad solution since the credit bubble and sub prime problem started by banks gave loan to unqualified people.

No advance country in this world have lower the interest rate to zero because it is not a solution to save the economy, it is the poison that will kill it once and for all.

Ben Bernanke, Henry Paulson and other fed/treasury department officials tend to forget the cause of this credit bubble: too much money in the economy and interest rate is too low(2003-2006). Now they wanna solve the problem by using the same method that created this problem? Give me a break.

Besides that, imagine what zero interest rate will impact the inflation rate. I heard a fool on Bloomberg saying he willing to give up some to inflation rate in order to save the economy. Well, the zero-interest-rate method will never save the economy and clearly, this person doesn't know about interest rate and its crazy effect to the inflation. Inflation rate will shoot the moon if we do that. Dollar will fall through the ground because there will not be any carry trade and money supply is so much that you can simply pick up money off the ground!

Like Jim Rogers and every smart economist said: US is doom!

28.10.08

100 Basis Point = 100 Basis Point.

last Friday s/p 500 dropped 31.34 point or 3.45% and yesterday dropped 27.85 point, so it had a two day drop of around 60 point. Mathematically and logically, FSSTI of Singapore should follow closely to that figure but instead market rally 1.65%.

What make FSSTI surges today? and what make Hang Seng, Nikkei, South Korea and pretty much all asia stock markets rally?

The answer is very simple: FOMC rate cut decision.

Everybody thinks 50 basis point cut or above. Some even say 100 basis point. However if Fed cut 50 basis point, the key rate will be at 100 basis point or 1.00%.

Let me walk you to the history of modern US economic and see how many times fed fund rate at 1.00% and what's the implication to the economics.

Fed fund rate or interest rate of US started in July of 1954 as a benchmark rate that Central bank lend money to banks. Since then, the lowest nominal fed fund rate was 100 basis point and it only happened once which was at June 25, 2003. The rate lasted around one year before a 25 basis point hike on June 30, 2004.

IF FED CUT THE KEY RATE TO 100 BP, WE WILL HAVE EXACTLY THE SAME SITUATION AS 2003. IN BOTH SITUATIONS, FED TRY TO PREVENT THE RECESSION AS A RESULT OF A BURST BUBBLE AND FED LOWER THE KEY RATE ALL THE WAY TO 100 BP TO PREVENT THE RECESSION FROM BURST BUBBLE.

HOWEVER WE ALL KNOW IT DID NOT PREVENT THE PROBLEM, IT JUST MAKE THE PROBLEM BIGGER AND HARDER TO SOLVE(EVEN GREENSPAN KNOW THAT). WHY IS FED LED BY BERNANKE DOING THE EXACT SAME THING JUST LIKE 2003 WHEN WE ALL KNOW IT IS WRONG AND WE ARE SUFFERING FROM IT NOW.

WHAT CAN FED DO NEXT? CUT THE KEY RATE ALL THE WAY TO ZERO? PRINT MORE MONEY AND BUY ALL THE TOXIC PAPER? LEND TRILLION OF DOLLAR TO BANKS AND CAR COMPANIES?

REMEMBER, 100 BASIS POINT THAT CAUSE THE CREDIT BUBBLE NOW IS EXACTLY THE SAME AS 100 BASIS POINT THAT WE WILL HAVE TOMORROW. ONLY THIS TIME WE MAY NOT HAVE SOME PROSPEROUS ERA LIKE WE HAD IN 2003 TO 2007.

27.10.08

What Is The Crude Oil Price In RM Term?

First of all, crude oil prices differ in different markets such as New York Mercantile Exchange(NYMEX), Intercontinental Exchange(ICE) etc. NYMEX crude oil widely considered as the benchmark of world crude oil price so I will use NYMEX crude oil in our calculation.

NYMEX crude oil price (currently) = USD 61.72

In RM term = USD 61.72 x 3.571

= RM 220.4

1 barrel = 115.6 litres

So, 1 litre of crude oil(RM) = RM 220.4/115.6

= RM 1.91 (compare to market price of RM 2.30)

Crude oil price on 1st Oct. 2008 = USD 98.53/barrel

= RM 3.04/litre

Average between 1st Oct. 2008 and now = (1.91 + 3.04)/2

= RM 2.475

According to CNBC.com, crude oil price may fall below USD 50/barrel as slower demand as a result of global recession.

Malaysia government officials said petrol price (RON97) cut will not exceed RM0.15. It mean petrol price won't go below RM 2.15

So if current NYMEX crude oil price stand till end of the month, it will be at RM 1.91/litre and October average is RM 2.475/litre.

However Malaysia is a oil producing country so there will be subsidy given by government to Malaysian like other oil producing countries.

RM 2.475 (NYMEX crude oil price - Oct. average) - RM 2.15 (if government cut petrol price by RM 0.15) = RM 0.325(Subsidy by Malaysia Government and Petronas)

So next time you wanna calculate the petrol price in RM term, use the formula above. At least you know what is the resonable price level of petrol prices.

Another Round Of Rate Cut?

So now everybody say we need another round of rate cut. Fed will announce it on Wednesday and UK PM also signal that rate cut is needed. According to Bloomberg, rate cut concencus is 50 basis point to 1%.

Fed Fund Future show that 50% chance of a 50 basis point cut, 30% chance of a 75 basis point cut, 10% chance each on 25 basis point cut and 100 basis point cut. Fed fund future also show 99% of a rate cut this Wednesday.

I really can't understand what are US officials thinking. Even Alan Greenspan admitted that he was partially wrong after the dot-com bubble burst which he apply a silly monetary policy(interest rate at 1%). This stupid policy create the credit bubble that burst 1 year ago and help drag down several banks and a insurance company.

However despite alan greenspan speech, Bernanke is trying to do the exact thing now. If Fed cut 50 basis point, we will have 1% interest rate exactly like 2005. Imagine if a dot-com bubble turn into this horrific credit bubble which was so much bigger, what will a credit bubble turn into? A bigger credit bubble?

No one knows the answer but we know it will create something even worse. Why can't Fed just lay their hands off and let the bubble go away so that we will have a fresh start. As long as fed keep intervening, they will create bigger and worse bubble.

Yes, we will have severe recession or even a depression of fed let free market system in control but at least we still have a small chance of survival. What fed do will certainly kill the biggest economy in the world.

Here is a sentence i picked from cnbc.com about market sell off of 20th and 21st century:

Crash of 1929

The stock market crash of 1929 saw the market fall 12.8 percent on Oct. 28, 1929, known as “Black Monday," but the market fell almost as sharply the day after. The crash contributed to the Great Depression of the 1930s and many also consider it part of a two-decade bear market.

How can the crash contributed to the GD? the stock market crash didn't cause the Great Depression--the Great Depression caused the stock market crash. In other word, stock market is the indicator of economic condition. If Economy is sound, stock market is sound and vice versa. So Black Monday happened because of bad economic condition and not contribute to GD.

So for those who look for bottom, you will have to wait some more. As long as central bank intervene, market will continue to fall.

25.10.08

Why US Stock Market Just Can't Drop Further?

However that's not the best story of the day. The most incredible story is that US market only drop less than 4% even before the US home sale report coming out. That's story is more amazing as S/P 500 was suspended from trading earlier today.

So i gonna do my best to answer the question that everybody ask (at least i receive a lot of email asking me this): Why US Stock Market just won't drop like other stock markets around the globe. Although Dow Jones and S/P 500 drop a lot this year, it is nothing compare to Hang Seng, Nikkei, FTSE, FSSTI, CAC, DAX or other stock markets.

1. Money

First of all, US are a lot wealthier than what we think they are. It's a 10 trillion dollar economy. Their economy is by far the most advance in the history of mankind. The pension fund in US hold trillions of dollar and average US citizen is wealthy even if US companies are not. A small portion of one pension fund is enough to make the market turn from red to green.

2.ADR

US stock market have the biggest amount of companies listing on it. A lot of them are American Depositary Receipt. Most of ADR companies are super blue chips in their respective country. That's why these ADR are well supported by funds from their country. Although all the ADR are not included in the Dow, Nasdaq or S/P500, they are giant in their industries and when they rebound, the whole industries will too.

3.Short Seller

Short seller. Short sellers are the single most important group for the US stock market. They are important not when they short sell but when they cover their position. Us stock market had it worst week in history when short selling was banned by government. It simply take away the buyer from the market as no short seller were they to take profit and cover their position(short sellers become buyer).

4.Irrational

US stock market has no correlation with the economy. Along the history of US economy, there were none indicator show any correlation between US economy and stock market. As we know market is irrational and unpredictable. Investor and trader buy and sell not based on current economy status by based on current emotion.

5.Government and Politics

First of all the US presidential election is just 2 weeks away. As we all know, prior to election stock market will surge as speculation aspect come into play. Either Obama or McCain comfirms that more government is needed to heal the economy and investor like it (although it won;t help US to recover). So government had intervene a lot previously and will intervene more in the future.

At the moment(3.05pm), Dow only drop 175 point(2.1%), Nasdaq drop 27 point (1.69%) and S/P 500 drop 19 point (2.1%). I won't be surprise at all if US market close today in the positive zone.

20.10.08

Bernanke-Paulson-Bush Coalition Want More!

19.10.08

"In The Long Run, We're All Dead"

This is the famous quote of late great John Maynard Keynes, founder of Keynesian Economy.

Today George W. Bush said economy will bounce back in the long run. The whole article is here so check it out.

http://biz.yahoo.com/ap/081018/meltdown_bush.html

There are a lot of questions exist here:

---Is George W. Bush knows anything about economy? Is he study economics in his college? The answer is no.

---In Economics term, long run mean period longer than 10 years. In other word, long run mean 10 years to infinity. So what Bush mean economics will recover in 10 years to infinity time period. When is it, President?

---What you mean by economy will bounce back? GDP will rise? Saving rate will rise? Interest rate will rise? debt level will fall? inflation rate will fall? Jobless claim will fall? unemployment rate will fall? Trade deficit will shrink? Dollar will appreciate?

Economy consist of so many thing and yet Bush think everything will recover and bounce back without mention which one recover first.

Well that's prove point 1 correct.

---"The federal government has responded to this crisis with systematic and aggressive measures to protect the financial security of the American people," Bush said. "These actions will take more time to have their full impact. But they are big enough and bold enough to work." Congress gave Bush a $700 billion plan to buy bad assets from banks and other institutions to shore up the financial industry.

This speech raise even more questions:

---Did the federal Government responded to this crisis with systematic and aggressive measures? exactly 1 year ago when the subprime bubble burst, every government official assured us that nothing is threatening the sound US economy. Few months ago, those same official came out again and said the same thing.

Besides that, what he mean by saying "systematic and aggressive measures"? Let us think what have the government did in the past year. All I can think of is lowering the interest rate to ground and inject money into the economy, and that's pretty much all they can do.

Wait a second, you may argue the whole subprime problem and credit bubble started with low interest rate and high money supply and you are absolutely right.

The credit bubble began with low interest rate and high money supply and US government try to fix the problem with the same way they started it. What is wrong with them?

A drug addict began with taking drug and we won't cure him with more drug, will we? Well, unless you are US government, no person in the world will do that.

---Bush also said the 700 billion bail out plan is bug enough to solve the problem.

700 billion vs 10 trillion of national debt. My math is poor but i think the 10 trillion is a lot bigger that the 700 billion.

Besides that, Fannie and freddie already taken away trillion of US dollar not to mention Bear, AIG, Indymac......

The US government have been pumping trillions of dollar into the economy and it does not solve the economy but now Bush think 700 billion is enough.

Let me tell you what 700b will do. 700 billion can only assure that some big and lousy companies won't foreclose. It will never solve the fundamental problem exist in the economy.

How can you solve a 10 trillion dollar economy with only 700 billion?