27.12.10

Well Done China!!!

Ever since the phillips curve created by William Phillip in 1958, which shows an inverse relationship between Inflation rate and unemployment rate, very few nations choose the maintain price stability. They were more concern on the rise in unemployment rate.

Then in the 1970's, rational expectation and non-accelerating inflation rate of unemployment (NAIRU) arose that explain the long run relationship between inflation rate and unemployment rate. Unemployment rate will be at natural rate of unemployment in long run. Inflation rate on the other hand will fluctuate accoordingly.

Although the phillips curve is no longer used as it is too simplistic, the long run relationship between the inflation rate and unemployment rate is still correct according to NAIRU.

Since in the long run, we will have natural rate of unemployment, it is not hard for any economist to target inflation rate especially when we know that money neutrality concept holds (through countless number of researches).

It seems like China are among the first nation in the world that realize that and they start increasing their key interest rate as early as February of 2007. Although they did eventually lower the overnight rate to 5.31% on December of 2008, it is still among the highest interest rate in the world (lower than other well managed economies such as Brazil and India).

Since money supply is now considered as exogenous by some Economists, perhaps the best way of lowering money supply thus lowering inflation is increase interest rate.

US and other developed countries still maintaining a superbly low interest rate simple for the reason of boosting employment and GDP but look at the BRIC nations. They all have high interest rate and they all have powerful growth of GDP and GNP.

India are another well managed economy. The unemployment rate continue to decrease while the key rate is kept at such a high level.

We still have quantitative easing 2 (QE2) to come. It seems like developed countries are not going for interest rate hike anytime soon.

6.12.10

Do Business Students Need Macroeconomics?

Nowadays many business programmes (undergrad or postgrad) do not include any Economics paper. Some only offer Microeconomics (although they may call it principles of Eonomics or introduction to Eonomics). I had a conversation with a MBA graduate last week about this and according to her, business students do not need Macroeconomics. She said (quote)"business student only need to know Microeconomics such as demand, supply and elasticities. They do not need to know how to calculate GDP and unemployment rate"

This is my opinion as an Economics graduates to the question "Do business students need to learn Macroeconomics"

I think Business student need Macroeconomics more than they need marketing, logistic, human resource management etc. Macroeconomics is not a study of approaches to determine GDP or Unemployment rate. Macroeconomics is a study of the relationship of aggregate variables in Economics. Macroeconomics determine the effects and consequences of a change in an aggregate economics variable to another (or more) aggregate economics variable(s).

If unemployment rate increases, what will happen?

If money supply increases, what will happen?

If tax increases, what will happen?

Since business (firm sector) is a subset of Economy (other agents include consumer/ household, government and international sector), It can affect the economics and vice versa.

The best example of how Economy can affect business (firm sector) is during an economic crisis. Sub-prime crisis in 2007 started when Federal Reserve increased the money supply and decreased the interest rate after the Dot-Com bubble in 2001. Eventually it led to the overshooting of money supply and GDP and we all know the consequences after that.

During the crisis, the firm with best management team in the world either suffered decrease in profit, huge loss or even faced bankruptcy.

WHY?

I did a simple correlation of profit of firms in Malaysia, Singapore and Hong Kong. I used 3 economics variables: GDP, unemployment and money supply (M1) and 3 management variables: gearing ratio, company credit rating and quick ratio.

The result speaks for itself.

Correlation with profit:

GDP = 78.32%

Unemployment rate = 91.12%

Money supply = 92.85%

Gearing ratio = -18.5%

Credit rating = 38.75%

Quick ratio = 62.33%

In essence, Economics is a study of choices occurred results from unlimited wants and scarce supply. So Economics students study the management of resources and the flow of income.

For me, Economics graduates are similar to Business graduates. Only different is Economics students study the management of an (aggregate) economy while Business students study the management of a firm.

8.11.10

Bernanke VS Friedman

3.11.10

What's The Point, Obama?

One of the main issue that President Obama promised to change when he was selected to become the head of USA is Budget deficit and public debt.

As of October 10, 2010, the "Total Public Debt Outstanding" was approximately 94% of annual GDP ($13.616 Trillion) with the constituent parts of the debt ("Debt held by the Public") being approximately 66% of GDP ($9.01 Trillion) and "Intergovernmental Debt" standing at 34% of GDP .The United States has the 20th highest debt to GDP ratio of all nations, and has the fourth highest of the G8 Nations.

So what happen? Why budget deficit and public debt is still so high after almost 2 years in office. Where are the reduction in government spending? Where are the increase in tax?

Without the reduction of government spending and increment in tax, budget deficit will never go down.

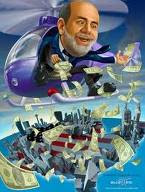

Federal Reserve on the other hand is not doing Obama any favor. After so many trillions injected into the economy and unemployment rate still skyrocketing, our helicopter Ben still haven't understand economics and continue his usual habit of dropping money with his latest plans to inject at least another $500 billion into the economy through bond purchases under its unconventional program of quantitative easing.

What's the point Obama? Where is the "change"?

THE Big Crash Coming

However the basic concept is the same: No government interference vs government interference. Many articles have been published by Nobel laureates.

It seems like everybody that knows about economy or economics favor one of them. Some argue the economy can't adjust itself and Government interference is necessary. Some argue government interference will only make matters worse and economics agents are rational to make neccesary adjustments.

Whichever school you are in (or you think appropriate), the very basic concept of accounting can be used to explain and possibly solve any economics crisis: Assets = Liabilities + Owners Equities.

The formula basically mean those with highest Assets and lowest liabilities are considered as richest.

Or is it??

In economics, we only use highest assets as the benchmark to determine wealth. In other words, countries or agents with highest assets (or production) regardless of the level of liabilities (or debt) are considered as wealthy countries.

With that in mind, it's amazingly easy to become rich and powerful country: borrow as much as you can and spend your way to prosperity. The more you spend and the more assets you own, the richer you are. In economics, if i borrow $10 from you, I am $10 richer and you are $10 poorer.

That's the reason why every government in the world encourage their agents to spend, spend and spend. It's the easy way to prosper.

For your information, this is the basic concept of Keynesian economics and sadly it is the dominant school of economics and almost all governments in the world are implementing it.

However, without understanding any economics, lets us use some logical thinking and comment sense for a moment: How can anyone become richer by borrowing and spending?

The answer is simple: you can't.

This is why we have some much big economics crisis since the Great Depression of 1929 (the start of Keynesian).

Anybody who watched "Wall Street" knew about the "Tulipmania". It was the only economics crash before Keynesian.

After Keynesian, Major economics crisis: crude oil crisis 1973, latin America debt crisis in early 1980's that led to a severe recession in the early 1980's, Economics crisis and Black Monday 1987, Russian economics crisis and Asia currency crisis in 1990's, Economics recession in early 1990's following the gulf war, Dot-Com bubble 2001 and recently subprime mortgage crisis 2007/2008. These are just the major and global economics crisis.

So what happened? Why Keynesian economics lead to so many problems in world economics?

The answer is again simple: Money and debt. All the crisis mentioned above caused by excessive money supply and debt.

Who control money supply and national debt?

GOVERNMENT.

The recent subprime crisis said it all. The whole recessions 2007 was the direct product of excessive money supply. Bank with so much money go to the subprime mortgage market and everything started from there.

Japan did the exact same thing as US in the late 1980's and try to spend their way to prosperity. They failed and yet to recover from the crisis known as "lost decade"

So can you see the pattern of major global economics crisis in the past 30 years:

1973, 1981, 1987, 1991, 1997, 2001, 2007.

What will be next?

I think it will be between 2012-2015 and the crisis will be more severe than 2007/2008. US and global governments did exactly the same thing each and every time: increase money supply and eventually it lead to a bigger and more severe crisis.

So the "crap" movie 2012 may be very bad, however the prediction may be correct after all.

2.11.10

High Income vs Low Income

However, what's the definition of high income?

According to world bank (in 2009), a high income economy is defined as a country with a per capita gross national income higher than $ 12,196 or more.

So if your wages is higher than $ 12,196 per annum, technically you are considered by world bank as high income person.

But are you???????????

Example: John and Gary are good friend. John stays at urban area and Gary stays at rural area. John earns $ 15,000 per annum and Gary only earns $ 5,000 per annum. Both of them are single.

John bought a house worth $ 100,000 last year (tenure = 25 years) with 4% mortgage rate and margin of finance is at 80%. The annual mortgage installment is $6,400. Gary rent a rural house at a rental fees of $ 2,000 per annum.

John also bought a car (tenure = 9 years) worth $ 50,000 with 4% interest rate and margin of finance is at 80%. That means John annual installment of $ 6044.44 while Gary still using his old motorcycle.

Standard of living in urban area is much higher than standard of living in rural area. Assume that Annual living cost for John is $ 4,000 while annual living cost for Gary is $ 2,000.

So who is considered as high income and who is considered low income?

World bank will defined John as high income group and Gary is defined as low to middle income group.

However John spend 16,444.44 per annum (with wages of $ 15,000) while Gary spend $ 4,000 per annum (with wages of $ 5,000).

Most of us will say John belongs to high income group with his since he is staying at urban area, drive a nice car and earns a handsome wages. For Gary who stays at rural area, rent his house and riding an old motorcycle, everybody will considered him as low income person.

However, is that true?

By ignoring the fluctuation in the prices of house and car (which offset each other), although John earns 3 times higher than Gary, Gary is the one with better money management. John overspent his income while Gary still have $ 1,000 unused income left.

There are 2 main problems for John:

1) Like most people who live at urban area, He used most of his income (around 83%) on hire purchase. Most people use around 40-50% of their income on hire purchase which is not healthy.

2) He buy something he can't afford. John bought his house and car on hire purchase which mean initially he can't afford both assets. There is a simple rule: if you can't afford it, don't buy it. I mentioned about debt many times so I don't think I need to repeat myself.

So make sure we distinguish clearly the borderline between high income and low income. High income means nothing without purchasing power and money management. It's not how much you earn. It's how much goods / services your wages can purchase.

5.10.10

An ignorant PhD

I met an ignorant PhD candidate. Here's what happened:

A PhD in computer science candidate and myself got into a small monetary dispute. I don't claim that I am an expert in financial regulation but I am an economics graduates with certificate in financial market regulation and asset valuation.

He came yesterday with no knowledge in finance, economics or financial market regulation. However he claimed that according to his own "law", I need to pay him money or "else" (although in reality, with annuity, I am his creditor).

He doesn't understand the concept of annuity in money, doesn't understand the regulation in financial market, doesn't even understand the general concept of money and yet he still claimed that he is right. (he does not even understand the concept of present value, future value and compounding interest)

With both financial market regulation and asset valuation books on my hands was not enough to convince him that his argument is pointless. He even challenge me to sue him in court which is irrelevant since the money involved is very small in amount.

I have no discrimination on computer science. I think this is a wonderful field that is making our life easier. However this PhD is one in a million that have no respect to law and regulation. I must be very lucky to bump into such a "wonderful" person.

25.9.10

Using Economy Theory to Answer Few Important Questions in Life 1

Lot of people think that economic theory is plainly theory and can't be applied in real world (although economist always prove a hypothesis using empirical study). My response to them are simple: they do not understand economics well and they do not understand economy in general.

Currently I am lecturing on the subject of Economics in a business school and the student can't see the reason why they need to learn economic. In their world, Business is everything and they think business subjects such as marketing, human resource management and logistic management are much more important than economics.

Well are they?

Recently I did a simple research on the correlation between the management quality and profit. To my surprise, no matter how I manipulate the data, the best correlation I get is +0.17. In other word, Management quality only 17% related to the profit of a firm. So where are the rest (83%)?

Predictably economy factor (GDP) has a correlation of +0.79 to the profit of firms.

It means no matter hard good is the management quality of a firm, Economy factors(such as GDP and inflation rate) are the dominant factor in determining the profit of a firm.

Back to our topic, I plan to give my opinion of basic questions in our life using economic theory. This is based on my knowledge in economics (hopefully enough lol) and experience in the financial markets. Note that the answer i give may vary according to the demographic and economic environment.

The first question i want to discuss is this: should you buy or rent a house?

Many people will immediately say we should buy. In fact many websites including Yahoo Finance have their analysis on the topic and conclude that you should own house(s).

However, is that true?

I will answer the question according to the variables in my country. However you can all apply the analysis in your own country perspective.

Let say we use a simple example as our focus of analysis. The price of an expensive house (300 square meter) in my area is around $ 750,600 and the average rent in that type of houses is $ 3,657

So which is better, buy or rent?

So we will calculate the monthly cost of each option and determine which is better option.

If I buy:

Interest cost (The base lending rate in commercial banks in my country is 5.75% p.a. and they will usually charge BLR + 1 to 5% depend on their evaluation. The normal mortgage rate is BLR + 2% which is 7.75% p.a.)

= (750,600 x 7.75%) / 12

= $4,847.625 or $ 4847.63 per month

Property Assessment tax

= (3657 x 12 months) x 4.5%

= 43884 x 4.5%

= $1974.78

Opportunity cost. Since you used your money to buy house (and forfeit the opportunity of investing in other financial instruments), opportunity cost occurred. Let say we use average 30 years T-bill rate for the last 5 years.

Average 30 years t-bill rate (last 5 year) = 5.32%

(750,600 x 5.32%) / 12 months

= $ 3327.66

Monthly cost of buying a house (not including principles) = 4847.63 + 1974.78 + 3327.66

= $ 10150.07 per month which is much higher than renting a house (average = $ 3,657 per month)

Furthermore there many costs and risks involved when you own a house. Tenant do not have to bear the cost of maintaining the house while landlord have to bear all the expenses involved.

Besides that, house owner need to bear risk of uncertainty (natural disaster etc) as well.

In conclusion, the theory is simple: if the marginal cost of renting a house vs lower than the marginal cost of buying a house, RENT IT.

Using our example, we should rent.

19.9.10

Mukhriz blames opposition for FDI plunge????

(Bernama) - Measures taken by the federal government have helped to attract foreign direct investment (FDI) this year contrary to the poor showing in 2008 and 2009 resulting from the opposition's disparaging remarks about the country, Mukhriz Mahathir said yesterday.

The Deputy International Trade and Industry Minister said the disparaging remarks directed at the BN government had instilled fear in foreign investors, so much so that FDI in 2008 and 2009 dropped by up to 81 percent.

When the investors kept away, the opposition blamed the federal government for what they claimed to be inefficiency in drawing investments.

"They cause the problem and they blame us for it. However, the government always does its best to attract foreign investors," he told reporters when met at the Aidilfitri open house of Pendang Umno Youth head Akrom Abdul Hamid in Pendang.

Mukhriz said the government measures had yielded RM5.6 billion in FDI in the first three months of this year, almost as much as the RM5.66 billion in FDI for the whole of last year.

He said the government, through the ministry, always held promotions for foreign investors regardless of which state, even those administered by the opposition parties, they wanted to invest in.

16.9.10

Rational Expectation, Irrational Decision Making

However, as far as I can see, the world is encountering a phenomenon i like to call "irrational decision making". Economic agents just do not select the best alternative based on available information. In other words, yes, they are selecting the alternative that they think is the best, but they are irrational to consider all the important information.

To demonstrate my point clearly, I will use 2 examples:

3.9.10

Malaysian money head overseas in Q2

Direct investment abroad (DIA) by Malaysian companies came in at RM6.2 billion, out-pacing the RM5.9 billion in foreign direct investment into the country.

The flow of money heading out in the second quarter saw a sharp increase from the first quarter of this year when only RM3.8 billion was recorded as DIA.

In the first quarter, Malaysia managed to attract RM5.1 billion in foreign investments, compared with the RM3.8 billions Malaysians invested abroad.

While Malaysians are sending more money abroad, Malaysia’s balance of payments deficit dropped sharply from RM19.6 billion in the first quarter to RM1.9 billion in the second quarter of the year.

“Overall, the strength of financial account remains weak and a sustained net inflow of capital would depend on the successful implementation of the New Economic Model (NEM) and Tenth Malaysia Plan,” said the CIMB report.

The Najib administration has been trying to open up the economy in a bid to make it a high income nation but was met with opposition from conservative vocal Malay rights group Perkasa which wants the status quo maintained despite widespread criticism that four decades of affirmative action has made the nation uncompetitive.

The government will also have to address the persistent net investment outflows as domestic private investment is a key element in its developed high income nation strategy.

The National Economic Advisory Council (NEAC) had submitted Part Two of the New Economic Model (NEM) to the Prime Minister today.

The second and final report from the NEAC was reported to contain 53 key policy measures aimed at eliminating cross-cutting barriers to a high income, sustainable and inclusive economy by 2020. It will be incorporated into the Economic Transformation Programme report to be released next month.

The research report noted that the reduction in balance of payments deficit was largely due to a marked reduction in errors and omission outflows (E&O).

The second quarter RM18.8 billion in E&O was down from RM30.5 billion in the first quarter, reflecting smaller foreign exchange revaluation losses as the ringgit appreciated moderately against major foreign currencies.

The CIMB report also noted that the nation’s current account surplus almost halved to RM16.2 billion in the second quarter from RM30.4 billion in the first quarter due to a lower trade surplus in goods amid widening services outflows.

“Reflecting a softer global demand, we expect the current account surplus will narrow further in the second half,” said the report.

It estimated current account surplus for 2010 to be RM103.2 billion or 13.7 per cent of GDP down from RM107.7 billion or 14.3 per cent of GDP previously.

The report said that E&O as a percentage of total merchandise trade and excluding foreign exchange revaluation had widened to between 4 and 6 per cent in the first half of the year as compared with 0.3 and 3 per cent during the period 2001-2009.

“As a rule of thumb, an “E&O” of not more than 5.0 per cent of total merchandise trade suggests no strong evidence of massive capital flight,” said the report.

Source: Malaysia Today.

Here is my analysis. Capital movement is easily tracked with capital account balance in balance of payment.

Malaysia is in deficit of capital account balance since 1974 and according to economics, interest differential is the main determinant of capital movement.

Malaysia's OPR is at 2.75% currently which is very low compare to other developing countries such as the BRIC, other south America countries and other east Asia countries.

That means Return for investing in Malaysia (Portfolio investment or Foreign direct investment) is too low relative to the risk (higher risk of uncertainty in developing countries).

Currently Malaysia is in a long streak of balance of payment surplus since 1999 as the current account balance surplus offset the deficit in capital account.

So, in conclusion, this is not a serious problem for Malaysia economy as most developing countries have deficit capital account balance (inflow of capital lower than outflow of capital) and current account surplus. Malaysia have much bigger problem in Government budget deficit as both central bank and government don't really know how to deal with it!

31.8.10

For Long Term Investors Stocks Are Cheap, Aren't They?

In fact stocks in the S&P now trade at just 11.7 times analyst estimates of operating earnings for the coming year. The P/E multiple is roughly back where it stood at the end of March 2009 just as the market was starting an 80 percent surge.

A lot of investors are kicking themselves for having missed that run-up. The question now: Should they jump in now to not to miss another? Are stocks cheap?

According to Mike Darda of MKM Partners, you should.

”Unless we are heading back into a recession and I don’t think we are, equities are more attractive than the alternatives,” he tells the desk.

"Equity earnings yields run between 7-9%." Darda explains. "That's several percentage points above where corporate bonds yields are and Treasurys are at 2.5%."

“I don’t know if the market goes up next week or even next month but if you have patience equities are the asset class to be involved in,” he concludes.

"I like US equities and global equities; and I like cyclical areas most," Darda says. "I think in 2011 we have above trend economic growth both globally and in the US."

Darda isn't the only one who sees value in stocks.

Mason Hawkins, CEO of Southeastern Asset Management, has trounced the market by buying stocks when others are selling, and he's been buying lately. His flagship Longleaf Partners Fund returned 4.9 percent annually in the past ten years versus a 1.6 percent decline in the S&P 500.

To get a sense of whether stocks are cheap, the 62-year-old Hawkins looks at how much of your investment you get back in earnings in a year. Based on analyst estimates, if you bought every Dow stock at Friday's 10,150.65 close, you'd get 11 percent back. Though you're not actually pocketing any cash, that's still a big return. After all, some relatively safe investment-grade corporate bonds are throwing off annual interest of 5.3 percent what you pay for them now. That means you'd get nearly six extra percentage points by holding stocks. Since 1932, the difference in yields between bonds and stocks following big drops in the stock market has been 2.8 percent, Hawkins says.

Of course, there's another side to this argument."Value schmalue," scoffs Michael Block of Phoenix on Fast Money. "Yes stocks are cheap right now but I see no reason that they couldn't get a lot cheaper. Dangerous times are probably still ahead of us."

This article from CNBC is garbage for a few reasons:

1. PE ratio is the single most overused and inaccurate financial ratio. PE ratio study the relationship between price of a share now vs the earning per share for the previous period which is misleading. A company that did well last quarter or last year doesn't necessary will do well today.

2. Those analyst missed one important point: US economy is going down and nobody can stop it (yep, even Helicopter Ben). If the economy going down, businesses will follow.

3. The rise from March 2009 is just a inflationary adjustment run. Technical bounce from the huge slump from Nov 2007 to March 2009 + trillions of dollar injected into the system need to be adjusted and as a result, assets price, including stocks price increase nominally. However the real price of stocks (vs gold, vs money supply or vs inflation) are falling all the time.

4. Money management is not about where to invest and to get the highest earning. It is not about bond vs stocks vs derivative vs currency vs money market instruments etc. It is not when bond yield very low, we buy stock. Money management is about risk management. it's about the reward to risk ratio and about maintaining the value of wealth. If there is nothing to invest, keep your money in the safest place. Put it into fixed money market instruments or short term government bond or physical precious metal.

29.8.10

28.8.10

When Will Bernanke Stop

Helicopter Ben are ready to throw in more money into the system to "help" the economy.

I think he is a shame to the field of economics and a shame to MIT, the institution that granted him a PHD in 1979.

How stupid is he?! Which theory is he using? How can a continuous expansionary monetary policy save the economy.

US interest rate already at 0% (well theoretically it is 0% to 0.25% but we all know all the banks will get 0%), what can you do with an economy that have 0% interest rate and high unemployment rate?

Create more money with 0% interest will only contribute to higher inflation. Even a degree level economics student know that but a PHD in economics from MIT can't see that!

one million dollar question: how much money created by Federal Reserve and Commercial banks in US? Money supply in US is now harder than rocket science. I truly believe if Feds announce the M3 in US, gold will shoot up to at least $10,000 per ounce and silver will go to $750 per ounce.

Let us look at US economy in term of macroeconomics objectives.

1. High but sustainability GDP growth - Fail. US GDP growth is horrendous. US GDP just came out of negative growth as government and Feds artificially pump up the economy with easy money.

2. Full employment - Fail. US unemployment rate is at 9.6%, highest rate in real term since the 1933 and highest ever in nominal term.

3. Price stability - Fail. Although official US inflation rate is at a very moderate growth and even have the risk of deflation, we all know that the actual inflation rate is much higher than that figures. With such a crazy amount of money created by Feds, it is impossible inflation rate can remain that low.

4. External balance - Fail. US domestic (government) deficit and external (international) deficit are unsustainable. Latest (2009) current account balance for US is $380 billions. That mean last year alone, US spend $380 billions more in international trading and where is that $380 billions come from? Yes, debt from China, Japan, middle east, Russia and countless countries that are debtor of US.

5. Sound currency - Fail. everybody knows that US dollar is dead. It will be replaced by other currencies such as Euro, Yen and RMB. The depreciation of US$ theoretically can boost export and reduce import but US current account deficit prove that US is still importing in a huge quantity. So depreciation of currency make it worse.

6. Equitable distribution of wealth - Fail. Just look at the bonus of banks' executives and look at the underpaid people in Mississippi, Alabama and Arkansas. US fail miserably in this area and the so called "capitalism" is just a term to discriminate the poor.

7. Increasing Productivity - Arguable. According to US Bureau of Labor Statistics, US labor productivity is higher than East Asia countries (japan, China, South Korea, Hong Kong etc.) and Eurozone (including France and Germany). However look at export and GDP growth of US suggest otherwise.

Wow! By analyzing US economy we will see how terrible it is. Fail in 6 out of 7 macroeconomics objectives!

Uefa Champions League and Uefa Europa League Draw

2010/11 UEFA Europa League group stage | |||||||||||||||||||||||||||||||||||||||||||||||

| Group A | Group B | ||||||||||||||||||||||||||||||||||||||||||||||

| Juventus (ITA) | Club Atlético de Madrid (ESP) | ||||||||||||||||||||||||||||||||||||||||||||||

| Manchester City FC (ENG) | Bayer 04 Leverkusen (GER) | ||||||||||||||||||||||||||||||||||||||||||||||

| FC Salzburg (AUT) | Rosenborg BK (NOR) | ||||||||||||||||||||||||||||||||||||||||||||||

| KKS Lech Poznań (POL) | Aris Thessaloniki FC (GRE) | ||||||||||||||||||||||||||||||||||||||||||||||

| Group C | Group D | ||||||||||||||||||||||||||||||||||||||||||||||

| Sporting Clube de Portugal (POR) | Villarreal CF (ESP) | ||||||||||||||||||||||||||||||||||||||||||||||

| LOSC Lille Métropole (FRA) | Club Brugge KV (BEL) | ||||||||||||||||||||||||||||||||||||||||||||||

| PFC Levski Sofia (BUL) | NK Dinamo Zagreb (CRO) | ||||||||||||||||||||||||||||||||||||||||||||||

| KAA Gent (BEL) | PAOK FC (GRE) | ||||||||||||||||||||||||||||||||||||||||||||||

| Group E | Group F | ||||||||||||||||||||||||||||||||||||||||||||||

| AZ Alkmaar (NED) | PFC CSKA Moskva (RUS) | ||||||||||||||||||||||||||||||||||||||||||||||

| FC Dynamo Kyiv (UKR) | US Città di Palermo (ITA) | ||||||||||||||||||||||||||||||||||||||||||||||

| FC BATE Borisov (BLR) | AC Sparta Praha (CZE) | ||||||||||||||||||||||||||||||||||||||||||||||

| FC Sheriff (MDA) | FC Lausanne-Sport (SUI) | ||||||||||||||||||||||||||||||||||||||||||||||

| Group G | Group H | ||||||||||||||||||||||||||||||||||||||||||||||

| FC Zenit St. Petersburg (RUS) | VfB Stuttgart (GER) | ||||||||||||||||||||||||||||||||||||||||||||||

| RSC Anderlecht (BEL) | Getafe CF (ESP) | ||||||||||||||||||||||||||||||||||||||||||||||

| AEK Athens FC (GRE) | Odense BK (DEN) | ||||||||||||||||||||||||||||||||||||||||||||||

| HNK Hajduk Split (CRO) | BSC Young Boys (SUI) | ||||||||||||||||||||||||||||||||||||||||||||||

| Group I | Group J | ||||||||||||||||||||||||||||||||||||||||||||||

| PSV Eindhoven (NED) | Sevilla FC (ESP) | ||||||||||||||||||||||||||||||||||||||||||||||

| UC Sampdoria (ITA) | Paris Saint-Germain FC (FRA) | ||||||||||||||||||||||||||||||||||||||||||||||

| FC Metalist Kharkiv (UKR) | BV Borussia Dortmund (GER) | ||||||||||||||||||||||||||||||||||||||||||||||

| Debreceni VSC (HUN) | FC Karpaty Lviv (UKR) | ||||||||||||||||||||||||||||||||||||||||||||||

| Group K | Group L | ||||||||||||||||||||||||||||||||||||||||||||||

| Liverpool FC (ENG) | FC Porto (POR) | ||||||||||||||||||||||||||||||||||||||||||||||

| FC Steaua Bucureşti (ROU) | Beşiktaş JK (TUR) | ||||||||||||||||||||||||||||||||||||||||||||||

| SSC Napoli (ITA) | PFC CSKA Sofia (BUL) | ||||||||||||||||||||||||||||||||||||||||||||||

| FC Utrecht (NED) | SK Rapid Wien (AUT) | ||||||||||||||||||||||||||||||||||||||||||||||

Bernanke Says Fed Will Do `All It Can' to Ensure U.S. Recovery

“The Committee is prepared to provide additional monetary accommodation through unconventional measures if it proves necessary, especially if the outlook were to deteriorate significantly,” the Fed chairman said today in opening remarks to central bankers from around the world at the Kansas City Fed’s annual monetary symposium held in Jackson Hole, Wyoming.

The Fed chairman gave a detailed analysis of the economy and said growth during the past year has been “too slow” and unemployment too high. Still, he said a hand off from fiscal stimulus and inventory re-stocking to consumer spending and business investment “appears to be under way.” He also said that the “preconditions” for a pickup in growth in 2011 “appear to remain in place.”

Bernanke said the risk of an “undesirable rise in inflation or of significant further disinflation seems low.” He said the Fed has several tools if prices decelerate, or job growth stagnates, including shifting the composition of its bond reinvestment strategy.

Stocks advanced and Treasuries declined after Bernanke’s comments. The Standard & Poor’s 500 Index rose 1.2 percent to 1,059.35 at 11:33 a.m. in New York. The yield on the 10-year Treasury note climbed to 2.61 percent from 2.48 percent late yesterday.

‘Ready to Take Action’

“The Fed is ready to take action if needed,” said John Silvia, chief economist at Wells Fargo Securities LLC in Charlotte, North Carolina. “They are aware the economy is not doing as well as expected.”

Federal Reserve officials put their exit strategy on hold this month and decided to purchase Treasury securities to keep their portfolio from shrinking as their mortgage bonds mature. Economists at Goldman Sachs Group Inc. and JPMorgan Chase & Co. say the Fed could boost monetary stimulus if the economy continues to deteriorate.

“The FOMC’s recent decision to stabilize the Federal Reserve’s securities holdings should promote financial conditions supportive of recovery,” Bernanke said. “Additional purchases of longer-term securities, should the FOMC choose to undertake them, would be effective in further easing financial conditions.”

Fed Symposium

The Kansas City Fed is hosting central bankers from more than 40 countries including Brazil, Malawi and New Zealand this year as well as economists from firms such as Bank of America Corp., Morgan Stanley and International Strategy & Investment Group Inc. U.S. central bankers next meet Sept. 21 for a one-day meeting.

Bernanke offered more detail on how securities purchases provide monetary stimulus.

“Specifically, the Fed’s strategy relies on the presumption that different financial assets are not perfect substitutes in investors’ portfolios,” he said. Fed purchases of Treasuries should push investors into other types of bonds with similar types of risks, lowering their yields as well, he said.

Risks of the strategy include a lack of “very precise knowledge” of the effects of the purchases and the chance that expanding the Fed’s balance sheet further “could reduce public confidence in the Fed’s ability to execute a smooth exit from its accommodative policies at the appropriate time.”

Communications Strategy

A second option, Bernanke said, would be to communicate that the Fed will keep its benchmark rate low for a “longer period than is currently priced in markets.” While the Bank of Canada’s 2009 adoption of the strategy “seemed to work well” there, a risk is that investors “may not fully appreciate that any such commitment must ultimately be conditional on how the economy evolves,” Bernanke said.

Lowering the interest rate on banks’ deposits at the Fed to 0.10 percentage point or zero from 0.25 percentage point is a third choice, Bernanke said. The effect of such a move on financial conditions “in isolation would likely be relatively small,” and it risks making the market for overnight loans, or federal funds, “much less liquid,” he said.

“In normal times the Fed relies heavily on a well- functioning federal funds market to implement monetary policy, so we would want to be careful not to do permanent damage to that market,” Bernanke said.

Proposal Dismissed

Bernanke dismissed a proposal by some economists to increase the Fed’s inflation goals “above levels consistent with price stability.”

“I see no support for this option on the FOMC,” he said. “Inflation would be higher and probably more volatile under such a policy, undermining confidence and the ability of firms and households to make longer-term plans, while squandering the Fed’s hard-won inflation credibility,” he said.

Bernanke spoke after the Commerce Department today cut its estimate for U.S. economic growth in the second quarter to an annual pace of 1.6 percent from an initially reported 2.4 percent pace. Reports on employment, manufacturing and housing in the past month have indicated the recovery is faltering.

“Incoming data suggest that the recovery of output and employment in the United States has slowed in recent months, to a pace somewhat lower than most FOMC participants projected earlier this year,” Bernanke said. “Consumer spending may continue to grow relatively slowly in the near term.”

Capital Spending

The economy is expanding at about a 1.7 percent annual rate in the current quarter, according to estimates by Macroeconomic Advisers in St. Louis. Capital spending declined in July, and sales of existing homes fell a record 27 percent. Manufacturing in the Philadelphia region weakened in August, according to an index compiled by the Philadelphia Fed.

Intel Corp., the world’s biggest chipmaker, today cut its forecasts for third-quarter revenue and gross profit margin, citing weaker demand for personal computers in mature markets.

“Investment in equipment and software will almost certainly increase more slowly over the remainder of this year, though it should continue to advance at a solid pace,” Bernanke said.

Back-to-back quarters of growth below 2 percent are likely to push unemployment higher and put more downward pressure on inflation, which is already lower than the Fed’s longer-term desired range, economists say.

‘Big Split’

“There’s a big split” on the Federal Open Market Committee “between people concerned about inflation rising in the future and those concerned about deflation,” said Dean Croushore, a former Philadelphia Fed economist who is now chair of the economics department at the University of Richmond in Virginia. “The Fed is unlikely to make any major changes soon.”

Economists estimate that the unemployment rate will rise to 9.6 percent in August from 9.5 percent in June and July, according to the median forecast in a Bloomberg News survey. The Fed’s preferred inflation indicator, the personal consumption expenditures price index, minus food and energy, rose at a 1.1 percent annual rate in the second quarter.

Fed officials said in June their longer-run preference range for inflation is 1.7 percent to 2 percent.

‘Sharp Downturn’

Consumer confidence has been sapped by this year’s 5.7 percent decline in stocks, with the S&P 500 Index falling 5 percent this year. Confidence rose less than forecast in August from an eight-month low, a Thomson Reuters/University of Michigan index of showed today.

Central bankers this month decided to reinvest about $18 billion a month of maturing agency and mortgage-backed securities back into U.S. Treasuries. They also adopted a $2.05 trillion floor for their securities portfolio.

Bernanke said that lower long-term interest rates increased mortgage refinancing, causing a more rapid prepayment of the Fed’s $1.1 trillion in mortgage-backed securities holdings. Further weakening of the economy, and even lower long-term rates could create “a bad dynamic” in the Fed’s portfolio, he said.

“Any further weakening of the economy that resulted in lower longer-term interest rates and a still-faster pace of mortgage refinancing would likely lead in turn to an even more- rapid runoff of MBS from the Fed’s balance sheet,” Bernanke said. “Thus, a weakening of the economy might act indirectly to increase the pace of passive policy tightening -- a perverse outcome.”

Mortgage Repayments

The Fed has already experienced about $140 billion of repayment of mortgage and agency debt, he said.

“Although mortgage prepayment rates are difficult to predict, under the assumption that mortgage rates remain near current levels, we estimated that an additional $400 billion or so of MBS and agency debt currently in the Fed’s portfolio could be repaid by the end of 2011,” the Fed chairman said.

Policy makers in August decided that allowing the Fed’s balance sheet to shrink when the economic outlook “had weakened somewhat was inconsistent with the Committee’s intention to provide the monetary accommodation necessary to support the recovery.”

27.8.10

BELA LUGOSI

"I love Bela Lugosi!!!!"

Although the blog is suppose to be the place where i talk about my though on the economies and stock markets, but i just wanna talk about Bela Lugosi as he will always be my favorite actor.

You can find about the man from the web with tons of information especially from Wikipedia, but i just wanna talk about the LEGEND from my point of view.

Before he was the "Master of Horror" in the US with his famous 1931 Dracula, he was the prime actor and stage performer in his native country: Hungary.

Political issues forced him to leave Hungary and went Germany where he had major success there for a brief time.

Upon arriving in US in December 1920, he started his acting career for European immigrants. At that moment he still don't know English at all.

After that, he starred in several films but only played minor roles. At the same time, he was a Broadway actor and played numerous time as Count Dracula, the role that will make him famous and ultimately, kill his acting career.

With some luck (death of Lon Chaney) and great efforts, He got his first major role in a motion picture in US and it was a big one. A movie that would define the horror genre for years to come: 1931's Dracula, directed by Tod Browning.

This movie is an instant classic. Lugosi and Dracula combined into 1 and it was marvelous. With such a tight budget, it managed to become the sixth highest grossing film in 1931.

Lugosi was so good at the role that his image of Dracula is permanently stamped into our brain as "THE DRACULA". although he was not the first Dracula (Nosferatu's Max Schreck was arguably the first), but he will always be recognized as the true vampire from Transylvania. However, he was paid $500 per week for 10 weeks of shooting which is considered extremely low. (for comparison, here are the prices of some of the goods and services in 1931: Average Cost of new house $6,790.00, Cost of a gallon of Gas 10 cents, A loaf of Bread 8 cents, New Car Average Price $640.00)

After Dracula, his acting career was constantly on the downhill. Although he got a new contract from Universal Studios, his pay never increased (500 per week).

The most important event in Bela Lugosi career beside Dracula is his rejection to the role of Frankenstein monster in 1931. According to Lugosi, "Anybody can moan and grunt". Little to his knowledge, he was killing his own career. Frankenstein monster was eventually played by Boris Karloff, and the rivalry between Lugosi and Karloff has begun!

Frankenstein become the highest grossing film in 1931 and Karloff become the new "master of horror" and number one choice in the horror movie actors list for Universal Pictures.

There are no true friendship in Hollywood. Lugosi and Karloff did not like each other and that was not a secret. Although they always denied this fact, it was undeniably true. I truly believe Lugosi regretted his rejection of Frankenstein monster roles till the last day of his life.

Nonetheless, Karloff career went on so great that he owned 2 Hollywood Walk of Fame. He starred in high budget horror movies from Universal Studios such as The Mummy and 2 more Frankenstein films. (Bride of Frankenstein and Son of Frankenstein, which Lugosi played Ygor).

Meanwhile, Lugosi always get secondary roles in Universal Studios horror films behind Karloff. He was so great as Dracula (in which he appeared with minimal makeup, using his natural, heavily accented voice) that his was typecast to similar roles.

To survive, Lugosi started to involve with independent film makers and as a result, he got dozens of "shitty" movies to his credit (although he was always great in every films).

After Abbott and Castello meet Frankenstein (which Lugosi played Dracula for the second and last time), Lugosi was forced to perform in front of small live audiences and stupid TV shows.

In 1952, he starred in Bela Lugosi Meets a Brooklyn Gorilla which was amazingly stupid and lousy yet quite entertaining. It was the last film before he was associated with Ed Wood, the notoriously bad director and producer.

Lugosi and Wood worked together in 3 films: Glen and Glenda (1953), Bride of the Monster (1955) and Plan 9 from Outer Space (1959) which had only 1 shot of Lugosi in his Dracula cape.

His career ended in 1956 (74 years old) when he passed away in his house on August the 16th, 1956.

For me, there are 4 reasons Lugosi career slumped so bad into working with Ed Wood and other lousy producers / directors:

1. His Accent. To be honest, some time i can't even listen to what he said in his films. His thick Hungarian accent limited his chance to shine in Hollywood.

2. His Ego. Lugosi got big ego and in some ways, it hurt his career. He always think that he is the greatest and as a result, make some silly mistakes (such as turning off the role of Frankenstein).

3. Karloff. Karloff greatness in Frankenstein put him in the prime seat in horror movie industries in the 1930's and directly nailed Lugosi into the coffin of shitty films.

4. Morphine. He was addicted to Morphine in the mid 1930, due to injuries received during military service in world war I.

For me, Bela Lugosi will always be the greatest actor of all time and certainly the ICON of horror movie for eternity (although some may feel Karloff is the best). Both of them are superb, but Lugosi could act in horror films without makeup while Karloff needed makeup to perfect his roles, and for me, that separate Lugosi with Karloff and perhaps, the rest of the world.

4.7.10

S&P 500

22.5.10

My Analaysis on FBMKLCI

I am an amateur in TA and this is the first time i publish such an analysis.

Now this is a monthly chart going back to 1999. I believe the 5 waves uptrend ends at early 2008 and we are going down.

Just look at the similarity between these 2 periods: mid 2006 to early 2008 high vs early 2009 to last month's high. Look at the momentum, macd and stochastic. everything is virtually identical.

Now i am not saying this market will move back to the floor of around 800 for sure but it sure has pretty good chance of doing that.