Keynesian VS Classical school of economics have been the main arguement in economics study for decades or even centuries. Then it changed to Keynesian vs Monetarist or Chicago school and recently Austrian school jumped into this battle.

However the basic concept is the same: No government interference vs government interference. Many articles have been published by Nobel laureates.

It seems like everybody that knows about economy or economics favor one of them. Some argue the economy can't adjust itself and Government interference is necessary. Some argue government interference will only make matters worse and economics agents are rational to make neccesary adjustments.

Whichever school you are in (or you think appropriate), the very basic concept of accounting can be used to explain and possibly solve any economics crisis: Assets = Liabilities + Owners Equities.

The formula basically mean those with highest Assets and lowest liabilities are considered as richest.

Or is it??

In economics, we only use highest assets as the benchmark to determine wealth. In other words, countries or agents with highest assets (or production) regardless of the level of liabilities (or debt) are considered as wealthy countries.

With that in mind, it's amazingly easy to become rich and powerful country: borrow as much as you can and spend your way to prosperity. The more you spend and the more assets you own, the richer you are. In economics, if i borrow $10 from you, I am $10 richer and you are $10 poorer.

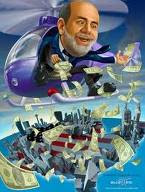

That's the reason why every government in the world encourage their agents to spend, spend and spend. It's the easy way to prosper.

For your information, this is the basic concept of Keynesian economics and sadly it is the dominant school of economics and almost all governments in the world are implementing it.

However, without understanding any economics, lets us use some logical thinking and comment sense for a moment: How can anyone become richer by borrowing and spending?

The answer is simple: you can't.

This is why we have some much big economics crisis since the Great Depression of 1929 (the start of Keynesian).

Anybody who watched "Wall Street" knew about the "Tulipmania". It was the only economics crash before Keynesian.

After Keynesian, Major economics crisis: crude oil crisis 1973, latin America debt crisis in early 1980's that led to a severe recession in the early 1980's, Economics crisis and Black Monday 1987, Russian economics crisis and Asia currency crisis in 1990's, Economics recession in early 1990's following the gulf war, Dot-Com bubble 2001 and recently subprime mortgage crisis 2007/2008. These are just the major and global economics crisis.

So what happened? Why Keynesian economics lead to so many problems in world economics?

The answer is again simple: Money and debt. All the crisis mentioned above caused by excessive money supply and debt.

Who control money supply and national debt?

GOVERNMENT.

The recent subprime crisis said it all. The whole recessions 2007 was the direct product of excessive money supply. Bank with so much money go to the subprime mortgage market and everything started from there.

Japan did the exact same thing as US in the late 1980's and try to spend their way to prosperity. They failed and yet to recover from the crisis known as "lost decade"

So can you see the pattern of major global economics crisis in the past 30 years:

1973, 1981, 1987, 1991, 1997, 2001, 2007.

What will be next?

I think it will be between 2012-2015 and the crisis will be more severe than 2007/2008. US and global governments did exactly the same thing each and every time: increase money supply and eventually it lead to a bigger and more severe crisis.

So the "crap" movie 2012 may be very bad, however the prediction may be correct after all.