30.9.08

Thank You!

Sure, Bernanke, Paulson, Bush and most other official are not the reason all this economy turmoil started, but they certainly are those who try to keep it running wild at us, the lower and medium class average joe.

The house of representative did the absolute right thing. You all have my applause.

The Dow Jones Wilshire 5000 Composite Index recorded a paper loss of $1 trillion across the market for the day, a first.

However, the house saved 700 billion ++ from flushing down to hell. They could save more trillions worth of cheap US dollar!

Dow drop 777, big deal! Here's my question to all the so-called expert: why can't dow drop 700+ point? why stock market can't fall?

The damage in the economy has already been done. No matter what happen to US and world stock market, economy still in turmoil. Remember this: stock market crash will never cause an economy collapse; economy collapse is the only reason stock market crash.

However, good time went away fast. Just 1 day after the great news, lawmaker plan another new bailout deal.

"Doing nothing is not an option," House Majority Leader Steny Hoyer, D-Md., said after seeing the $700 billion emergency package for the nation's financial systems fail 228-205 on Monday.

Surely that's another stupid person. Doing nothing is always better than doing destruction to the economy. They keep telling us that doing nothing is not an option and financial institutions will fall. However, Federal Reserve has been helping these companies from day 1 and some of it still collapse. Bear Stearns, Indymac, Freddie Mac, Fannie Mae, Lehman, AIG etc. has been helped by Federal Reserve all the way and they still down. So how can Federal Reserve prove financial companies will survive?

Today market will rebounded sharply as stupid traders will be bullish about the new bail out plan. Let them lose their money if they want. Dow and s/p 500 are going nowhere but grave. See you at 7400, Dow and 750 for s/p 500.

28.9.08

Hank Paulson: Man of the Moment

He's the man who is getting $700 billion to bail out the nation's financial system. He personally drove the US government acquisition of insurance giant AIG and stepped in to engineer the nationalization of the formerly private mortgage behemoths Fannie Mae and Freddie Mac. He cajoled Jamie Dimon and Alan Schwartz to consummate the fire sale of Bear Stearns to JP Morgan Chase with a promise of $29 billion in financing from the Fed only to decide a few weeks later to allow the equally venerable Lehman Brothers to go into bankruptcy.

Move over Senators Obama and McCain and make way for the most powerful Treasury Secretary to come our way in modern times. He's Henry Merritt Paulson Jr., a.k.a. Hank. He leads a department that employs over 110,000 people and important institutions including the IRS, the U.S. Mint, and the FBI. But who is Hank Paulson? Where did he come from? What drives him? How has he changed since grudgingly agreeing to come to Washington in 2006 after a distinguished career culminating in becoming chairman and CEO of the bluest of blue chip firms, Goldman Sachs, and where does he go from here?

To get at these questions and push beyond well known sources, I interviewed a cross section of current and retired Goldman Sachs partners, including two members of Paulson’s executive committee, as well as a variety of leaders from the financial community more broadly. Let’s take each of the above questions in turn.

Who is Hank Paulson?

Now 62, Paulson was born in Palm Beach, Florida and grew up in a suburb of Chicago, Barrington Hills, Illinois. As a youth excelled in just about everything he did. He was an Eagle Scout, a star football player, and a talented student. He attended Dartmouth College, graduating with Phi Beta Kappa honors in 1968, where he reveled in protecting his quarterback and breaking holes for his running backs as an all-Ivy League offensive lineman. He was a direct admit to Harvard Business School, graduating in 1970.

As a person Paulson is direct and self-confident with a palpable inner strength. Some say this comes from his faith as a Christian Scientist, which prohibits him from smoking or drinking. He and his wife Wendy have two children, daughter Amanda, who is a journalist for the Christian Science Monitor, and a son, Merritt, who owns minor league baseball and hockey franchises in Portland, Oregon. Disciplined about keeping fit, Paulson has always been an adventurer, traveling the world, and developing a passion for and expertise in environmental work and endangered animal species.

His career has been a model of private sector accomplishment and public service leadership. After receiving his MBA, Paulson went to Washington to become staff assistant to the Assistant Secretary of Defense at The Pentagon. Two years later he moved to the White House, serving as assistant to John Ehrlichman from 1972 to 1973. He joined Goldman the following year in the firm's Chicago office and became a partner in 1982. He rose through the investment banking group, becoming co-head in 1990. At the end of 1994 Paulson became chief operating officer of the firm, and in June 1998 succeeded Jon Corzine (another famous Goldman alum now Governor of New Jersey) as chief executive.

When President Bush asked him to become Treasury Secretary, he is said to have balked; and for good reason. The two prior Treasury Secretaries, Paul O’Neill, former CEO of Alcoa and John Snow, former CEO of railroad giant CSX, were regarded as largely ineffective and what’s more, the President had only two and a half years left in what was an increasingly unpopular term. Paulson told the President that he would only agree to the job if he was guaranteed to have the authority to make an impact. Since his confirmation by the Senate in June 2006, he certainly has had his authority and he certainly has made and continues to make his mark.

What Motivates Him?

People who know Paulson stress that his motivation is pure, to help achieve stability in the financial system and the economy. He genuinely views his role as giving back to the nation and to the industry that has given him all of his advantages. He has a deep faith in markets but also in a role for government, especially when markets break down.

Paul certainly did benefit from the markets, which have afforded the financial opportunities from his career at Goldman Sachs. While he took a significant pay cut moving into Treasury, it was from an atmospheric level, swapping out more than $20 million in annual compensation for a governmental salary of $183,500. He also built an equity stake in the firm that grew to approximately $500 million which he had to sell prior to joining the Cabinet (like other federal appointees, he benefited from a capital gains tax exemption given to all who have to sell their holdings prior to taking office).

A $700 Billion Checkbook

Last Saturday, the Bush administration formally proposed a vast bailout of financial institutions in the United States, requesting unfettered authority for the Treasury Department to buy up to $700 billion in distressed mortgage-related assets from banks and other private firms. The proposal, which would raise the national debt ceiling to $11.3 trillion, is notable for its simplicity and the power it will bestow upon Paulson. It would grant the Treasury Secretary unprecedented authority to buy and resell mortgage debt with no restrictions other than requiring semiannual reports to Congress.

The bill seems certain to be approved swiftly by Congress, which is a testament to the credibility that Paulson has earned with his hands-on management of the current financial crisis. It should be noted that a key part of Paulson’s effectiveness and credibility is based on the seamless partnership that he has built over the past two years with Federal Reserve Chairman Ben Bernanke (during the current crisis they reportedly speak up to ten times a day). Together they forged the ambitious plan to buy $700 billion in troubled assets with taxpayer money.

To put the $700 billion in context, it is roughly equal to what the United States has spent so far in direct costs on the Iraq war and more than the Pentagon's total yearly budget appropriation. Another way to look at it, spread across the entire population, it would amount to more than $2,000 per person.

I asked a leading real estate investor, who oversees a market-outperforming multibillion dollar fund, to give me his assessment of Paulson’s performance. “I'm incredibly impressed with Hank Paulson's decisiveness, leadership and pragmatism,” he said. “I remain scared to death of what the ongoing de-leveraging and reversal of years of lax credit may still lead to, but I believe that history will applaud his interventions.”

Another senior Wall Street executive told me, “Paulson has been very hands on and taken the captain’s chair. He stepped up to the plate while the White House and Congress simply didn’t know what to do. It is not an overstatement to say that Paulson’s aggressive interventions, with Bernanke’s support, helped prevent a crash of the world financial markets. Like him or not, you have to respect him.”

How has Paulson’s Management Style Changed Since Goldman?

If you watch Paulson at press briefings or in Senate hearings, you get a sense of the man. Some of the adjectives that describe him best are direct, intense, powerful, serious, competitive, can-do, and frankly, ballsy. One of his former Goldman executive committee members said, “Hank hasn't changed at all since he was at Goldman. Literally.” Another current partner added, “He is exactly the same, very forceful and willing to take the lead and take a position. But he also uses a strong team around him to affect the game plan. I think he has done a tremendous job in the face of extreme pressure and be willing to make tough decisions. Thank goodness he is in the job.”

Where Does Paulson Go From Here?

Common sense would dictate that Senators Obama and McCain would plan to keep Paulson on as Treasury Secretary. He has said publicly that after he leaves his Treasury post, he would like to play a leading role in environmental work on a global basis. However, the aforementioned real estate investor, who like Paulson is a Dartmouth grad, has a somewhat different plan for the Secretary. “I’d like him to remain Treasury Secretary for the time being, but only until he accepts the role of Dartmouth's seventeenth president in 2009!”

Latest Technical Analysis on World Market Index

20th September: Two interesting signals last week. First, the NYA touched an important long term support at around 7,400. I wasn't expecting this so soon. But perhaps the sooner the better. See the ninth chart below. It shows a turn on a very good support. Best case scenario would be another fall to that support and a double bottom forming over the next few months. A similar bottom reversed the market in 2003. By contrast the Dow and the S&P500 don't show anything very interesting.

The other interesting thing is 3-day collection of new lows in the 1000 range. On three previous occasions the market has made short term reversals when new lows exceeded new highs by 1000 stocks. Previously we have seen the market rebound after a 1000-new low session. With luck, the recent three-day spike of new lows in the region of 1000 will precipitate more than a mere short term reversal.

In other news, the XOI chart, representing most of the oil majors, merely pulled back to a menacing top.

Hong Kong

20th September: The index plunged to support at around 16,000 before rebounding sharply. The weekly chart shows the index ending flat for the week. But many blue chips indicate that there is still a danger of further falls for the market. What does that mean for the market? (Sign up for my seminar and find out!)

Current prediction

Long term: Weekly chart head and shoulders top points to (log) 14,600; (arithmetic): 11,750 - not yet confirmed

Japan

20th September: The index has reached our log target. Support on the weekly chart at 12,200 is broken. The trend is still bearish.

20th September: The index has reached our log target. Support on the weekly chart at 12,200 is broken. The trend is still bearish.

Current prediction

Long term: double top (daily) points to 11,200 - done (log), 10,300 (arithmetic)

Malaysia

20th September: The index is testing good support at around 1,000. The top suggests that the support will break.

Current prediction

Medium term: 1. head and shoulders top daily chart points to 910 (log), 830 (arithmetic)

2. head and shoulders top weekly chart points to 930 (log), 860 (arithmetic)

Singapore

20th September: The index has reached log target for our tops in the daily and weekly charts. But there is nothing to suggest that the bearish trend has reversed.

India

20th September: The index turned on support at 12,500. Let's see if it holds.

20th September: The index turned on support at 12,500. Let's see if it holds. Current prediction:

Medium term: double top points to 10,500 (log); 8,800 (arithmetic)

23.9.08

The Neverending Story 4: Bail Out

This time around, US Government will borrow money from government of Afghanistan, the last country that willing to borrow money to US government. All other countries in the world has borrowed money to US government and all they got is some worthless recycled paper.

Today, Federal Reserve Chairman, Phillip J. Fry of the Futurama Series, announce that all US citizen will willing to work as farmer for other countries to repay their country's debt, standing at amazing 35,000 trillion.

Also, a humanity group in Mexico City willing to give free loaf of bread to American as a sign of sympathy. It is heavily criticized by other Mexican that claimed America government has discriminated them for over a century.

Inside a small hut, a regular American child ask his father a question: i read in the history book and it said US used to be the richest country. What happened?

Father: "Well, it all began at March of 2008 when the US government agreed to bail out Bear Stearns. After that, Indymac, Fannie mae, Freddie mac, AIG. After that Henry Paulson and Ben Bernanke came out with a 700 billion bail out plan......"

Child: "Daddy, why American agree to the plan?"

Father: "Well we didn't but the politician agreed so the plan was launched and here we are."

Child: " Stupid politician."

Oil Is Expensive Again

As a result, crude oil rally. Light, sweet crude for October delivery jumped as much as $25.45 (24.2%) to $130 a barrel on the New York Mercantile Exchange before falling back to settle at $120.92, up $16.37. This is the biggest rally that crude oil ever have.

If you think crude oil will stop from rallying, then you are wrong. This is just the tip of an ice field. Not only crude oil rallies but most major commodities rally too. Gold future up 40 dollar or 4.73% to 905 per ounce, Soy oil up 2.63 or 5.55% to 50.03, corn up 16.25 or 3% to 558.50.

Dollar fell against every major currency in the world. Dollar index fell 1.54 or 1.98% to 76.4. Dollar fell between 1.35% to 2.5% against major currency in the world which include Swiss Franc, Euro, Aussie Dollar, Pound, Yen and others.

I can guarantee you if government continue to act like this, commodity will boom like crazy and dollar will fell like it is worthless but there are no evidence government will stop their silly move!

So protect your wealth and earn profit from this situation. Sell US dollar against any major currency in the world and long any important commodity such as gold, silver, crude oil, soy oil and soy bean.

For those who already make money from that, Thank you to US government because at least they will make something rise!

Bailout Plan Expected to Be A Drag On US Economy

“The Wall Street mess will now have collateral damage to the real economy,” says Steve Hanke, a former White House economist. “We're coming into this thing in a terrible situation.”

Hanke and other economists see some similarities with Japan’s decade-long economic malaise – combination of real estate asset bubble, banking crisis and misguided and expensive government intervention.

“A lot of the symptoms of the pain and adjustments will be exactly the same, “ says Hanke, now with the Cato Institute and Johns Hopkins University. “We've got some major adjustments coming in the economy, some major slowdowns.”

Depending on who you ask, that means anywhere between two to five years of no growth or slow growth, while the government rescue plan plays out along, the housing and real estate sectors stagger to recovery and the American consumer restores his own shaken balance sheet.

Opponents of the $700 billion plan see no payoff for the real economy. “This plan is not about housing, not unless you’re talking about investment houses.” Says FAO Economics Chief Economist Robert Brusca. “This is not a plan aimed at reviving the economy. This is all about trickle down.”

Even those who view the plan as necessary but insufficient see hard times ahead..

“The consumer needs repair, job layoffs are increasing, real wages are not increasing,” says money manager James Awad, managing director at Zephyr Management. “In the corporate sector, everybody’s in a protect-your-balance–sheet-mode. Most corporate executives are going to think cash is king. Overseas economies are slowing, which means exports are going to be a bit slower. So, that leaves the government and the government is constrained by huge deficits.”

Are we there yet? Sorry, but no.

“This is the beginning of the adjustment and the Fed and Treasury intervention slowing that down,” says economist Ram Bhagavatula, managing director at the hedge fund Combinatorics Capital. “Its not like this economy is ready to go if credit is cheap and flexible.”

“I think it is horrendous,” says former FDIC Chairman William Isaac. “There are less expensive way to stabilize depositors if people are nervous.”

Isaac notes that there were some 3000 bank and savings and loan failures between 1980-1991; depositors didn't panic “because they had confidence in the government,” says Isaac, now chairman of the Secura Group of LECG.

Japan Vs. US Cases

Most economists say the Japanese government made the mistake of extending the country’s financial problems by one form of intervention or the other – corporate aid packages, repeated stimulus packages with one-off tax rebates that consumers didn’t spend and a ever lower interest rates. The stock market sank and then languished for years.

In the US, the economy is suffering from both conventional and extraordinary forces. There’s the unwinding of the leverage bubble triggered by the historically low rates of the Allan Greenspan and near simultaneous defense spending explosion of the Afghanistan and Iraq conflicts as well as the cyclical downturn, which is gaining momentum and generating higher unemployment and layoffs.

Earlier this month, the Congressional Budget Office’s issued its baseline ten-year budget projections -- which assume no policy changes over the period – and forecast that debt held by the public would explode from $5.4 trillion in calendar year 2008 to $7.9 trillion in 2018.

Add to that, the government’s series of credit crunch crisis moves culminating in the Treasury plan and you have another $1.8 trillion at the minimum.

Hanke, who adamantly opposes the Treasury’s bailout plan, says the lessons of the Iraq-Afghanistan wars certainly apply and that uncertainly about the plan, as well as setbacks and/or outright failure.

“There will be lots of uncertainty to it,” he says. “Just think of the sentiment about the war on terrorism and how that deteriorated over time with bad performance. The same thing happens in the financial sector. There’s a huge overhang on the consumer side.”

That’s especially problematic at a time when consumer spending is slowing – along with tax receipts from most corners of the economy -- and the economy is expected to begin contracting as soon as the fourth quarter.

There’s also little chance of austerity with a new administration. Sticker shock about the bailout aside, the two contenders remain wedded to their economic proposals, none of which are likely to provide budget relief.

Hanke says “substantial increases in spending, put the economy on an unsustainable path.”

Sources: CNBC

Finally Someone Talk About Bail out Home Owner

"Democrats believe a responsible solution should include independent oversight, protections for homeowners and constraints on excessive executive compensation," said California Democratic Rep. Nancy Pelosi, the Speaker of the House of Representatives.

"It's ... hard to tell the average American that we're going to continue to have foreclosures that destabilize neighborhoods and deprive cities of revenues they need, but we're going to buy up the bad paper," committee Chairman Barney Frank said on CBS' "Face the Nation."

You can't just talk about wall street like how you gonna save wall street, how much money needed or it's too big to fail, but let main street to die!!!!!

Henry Paulson over and over again mention that the plan is our only choice and it has to be fast but he never tell us the other side of the story. He never tell us how we got here, he never tell us how severe the debt of US government, he never tell us how easy it's to solve this problem using free market mechanism. The reason of that is he can't let wall street down!

So now democrats throw the lifeline here about bail out home owner as well and suddenly Paulson, bernanke and bush silence. I think they are thinking "maybe not"

You can't talk your ass off about try to save the economy but actually only save wall street and big companies while let main street die!

Here's what Paulson said few moments ago:

"I won't bet against the American people ... We will work through this," Paulson said on NBC. "I wouldn't bet against the long-term fundamentals of the U.S. economy."

WHAT ARE YOU TALKING ABOUT! YOU ARE BETTING AGAINST THE LONG TERM FUNDAMENTALS OF US ECONOMY. YOU ARE BETTING AGAINST AMERICAN PEOPLE. IN FACT, YOU PUT THEM ON THE LINE. IF YOU SUCCEEDED, YOU STILL BLOW UP ANOTHER BIGGER AND MEANER BUBBLE BUT IF YOU LOSE, THAT'S IT. US ECONOMY SUCCESS STORY WILL FOREVER VANISH. 20 YEARS FROM NOW WE WILL READ ABOUT HOW GOOD AND DOMINANT US ECONOMY WAS.

22.9.08

100% Return in less than 48 hour?

EUR/USD: up 1250 pips

AUS/USD: up 700 pips

NZD/USD: up 300 pips

USD/CAD: up 750 pips

Then at 9.00am London time today i long EUR/GBP and EUR/JPY and it got me another 80 pips and 285 pips.

So all together around 3300 pips in less than 48 hour of trading time!

Now for those of your who don't know forex much, i used a 2700 dollar and got myself 90% margin so all together i invest 27000 dollar. Until now i already earned 33000 dollar.

So start taking advantage of silly decision by Paulson-Bernanke-Bush administration. Protect yourself from rising commodity prices. Invest in commodity too such as gold and crude oil. I bet you will make bigger profit.

Good Luck!

21.9.08

For Those Who Are Not American

The US lawmaker keep lowing the interest rate, increasing money supply and continue to borrow money from foreign government using T-bill will destroy the US dollar. Well, you may not hold US dollar but all the major commodities in the world are in US dollar term.

For those of you who still believe that price of crude oil rises from 20-30 dollar per barrel all the way to 147 US dollar per barrel is because of demand from China and India, you are absolutely wrong. Some of my friend even said the Olympics event in China will greatly increase the demand for crude oil.

At the same time the prices all major commodities in the world skyrocketed. eg. wheat, corn, soybean, soya oil, rice, gold, silver, platinum, natural gas, coffee, cocoa, sugar, cotton, orange juice, cattle, pork bellies and lean hogs. According to some officical sources, it's because of high demand. First of all, how can the demand for all these product increase all at the same time? Secondly how can the world increase demand for these commodities when US economy is in deep trouble?

Obviously it is not supply-demand thing happen around. The prices of all those commodities skyrocket because of weakening US dollar as all the major commodities in the world are in US dollar term.

So next time when you wanna pump in "expensive" gas, you know whose fault is that!!!!!

Another 700 Billion Dollar Flushed Down The Toilet

And believe your eyes. Yahoo Finance reported this: The economy could suffer a massive hangover from the government's efforts to rescue the financial system in the form of a soaring debt burden. But the alternatives look infinitely worse.

That mean the plan is bad, but it is better than using free market mechanism and solve the problem once and for all.

Wow!!! US education system clearly in trouble in the subject of Economic as all the so-called economists know nothing about economic.

We already know that The deficit for this budget year, which ends on Sept. 30, is expected to rise to $407 billion, a figure that is more than double the $161.5 billion imbalance for 2007, reflecting what the economic slowdown and this year's $168 billion economic stimulus program are already doing to the government's books.

Foreign governments have already own more than 10% of US economy and that's not enough? They gonna print more dollar, sell more t-bill to foreign government and keep depreciate the dollar? And that's the better way around?????

Clearly they have lost their mind. The largest and most important components of any economy is household(lower and middle class) and not rich and arrogant man that drives Ferrari. Household spending is the biggest contributor to any economy in the world. The "smart" economists from department of secretary and Federal Reserve claimed that commercial banks, investment banks, insurance companies and mortgage companies are too big to collapse while lower and middle class citizen are left to die?!

Everybody know no strong economy has weak currency. What Bernanke, Paulson, Bush and their gang do is destroying the dollar system and destroying the US economy. Forget about Osama bin Laden and all the terrorist in the world. The biggest treat to the US is Paulson, Bernanke, Bush and all the economist that agree to the plan. I can assure you if they keep doing this, about 10-20 years from now, US will definitely nowhere near the largest economy in the world and that most probably be China as by that time, China may own 30% or even 50% of the economy of US.

Republican United States Congressman from Texas, Ron Paul once said " the US economy now is like an drug addict. The best way to heal him is to stop giving drug to him. However what the US government does is keep giving larger and larger dose of drug to him until one day he will die. Stop giving drug to him now, he may suffer a while but after that, he will be a healthy man again.

Ron Paul is absolutely correct. inject money(drug) to US economy(drug addict) is definitely not the way to heal it. Short term suffering will ensure long term prosperity!

20.9.08

What Can We Learn About History?

So i think we should look back in history and find the solution for the problem we face now.

I will start our history lesson with the father of modern economy, Adam Smith. In 1776, Smith wrote the most famous economy book of all time, Wealth of Nations (901 page though, you should all get the copy and read it. If you can't find it, give me a message and i will send you my copy).

The main idea of WON is free market mechanism. Smith think and proved why our market should not be intervene by government. A new concept called "invisible hand" was introduced. He said let the business cycle roll itself(uptrend-constant-downtrend-constant and start again). If the government intervene, the business cycle will be interrupted and the natural and normal business cycle will no longer there. Then we will have severe economy down turn. The world agreed and the classical economic era started. Since then, everything was fine. Economy of the world was doing great and we were prosperous.

After 150 year of great economic system, we encountered another problem: Great Depression 1929. One of the main causes of GD is debt. The market interest rate was too low and people all over the world borrowed huge amount of money. Debt level was at tremendous level(just like now). Also, US suffered a huge trade deficit (again, just like now) and severe expansion of the money supply in the 1920s that led to an unsustainable credit-driven boom(one more time, same is happening now). So a new era begun: Keynesian. John Maynard Keynes think the economy should be regulated by an agencies and control the market interest rate and money supply(using monetary policy) so that if the invisible hand fail to control or take too much time to control the normal business cycle, this agencies will come out and and control the market interest rate from falling.

So now, the federal reserve are doing the exact opposing things from this two history occasions. First they ignored the Smith's free market theory at 2001 and prevent the bursting of the dot com problem and prevent the normal business cycle from doing it job. To prevent that, they created what we called a credit bubble. They blew this bubble all the way until it is much bigger that the dot com bubble and in August of 2007, it bursted. Then once again they ignore the Keynesian theory and the causes of Great Depression and start lowering interest rate which is exact opposite of what they should be doing.

Every time when you wanna prevent a bubble from bursting, you will create a bigger bubble. Instead of increasing the interest rate and lowering the debt level and money supply just like what saved the world economy during Great Depression, they lowering it! That mean they try to do something nobody dare enough to do: they challenge the great depression which i truly think they will lose to history. By that time, US will suffer a situation much worse than great depression. It will cause the US economy to fall all the way to its root and may never recover again.

To Ben Bernanke, Henry Paulson and rest of the "smart people", you wanna prove Adam Smith, John Keynes and rest of economist wrong, you should prepare to suffer the consequences.

God Bless America!

Where To Invest Now?

So you might ask me where to trade? Where to invest now? How to protect our capital and start making money?

Well first of all get out of stock market as it is going nowhere. wait for a few days for the market to shoot up higher then dump it.

Long the commodities, not the commodities stock. Two reasons why buy commodities instead of commodity stocks:

1) According to jim rogers, you will make 4 times higher when you buy commodity than commodity stock when commodity price goes up.

2) Commodity stock is in the stock market. When other sector of the stock market crash, commodity sector maybe affected too.

My choice: Precious metal. eg. gold, silver, platinum. Energies eg. crude oil. Grains eg wheat, corn, soybean, palm oil.

Besides Commodity, You should short the dollar against all major currency the world.

My choice: long Euro/USD, Aus/USD, NZD/USD, CHF/USD (long all those currencies against dollar). Two days ago I long Euro/Dollar at 1.4146 at now i already earn 265 pips!

I think dollar will retest their previous low against all those currencies.

Also, start reading the quality books from expert. I am on Peter Schiff's Crash Proof and Martin J Pring's Technical Analysis Explained.

FYI, the reason why some expert can predict the market correctly is because they look into the fundamental of economic and not just look at stock market. We all know stock market is irrational. Example, today the world stock market surge like crazy for two reasons: bail out plan and short selling rules. Those two so-called strategies will never make a worthless and rubbish company healthy again yet people still chase all the financial stock like there are no tomorrow.

Remember this: the stock price of a company never ever change the quality of a company. eventually those people who spend their hard earned money buying the share of financial companies will realize they actually buying a worthless piece of paper.

Take care!

19.9.08

Lesson To Federal Reserve: How To Really Save The Financial Companies

What have they done to save the financial institution:

1) Cut the key rate. (Especially in the US by ignoring the high inflation rate)

2)Inject liquidity into the economy (the amount of money pump is somewhere near 10 trillion maybe?)

3) Nationalize it.(we call it a "bail out" which mean buy the assets of a company that is in trouble of bankruptcy)

4)Press conference(can you count how many times Paulson, Bernanke, Jean-Claude Trichet, Hidetoshi Kamezaki or other president of central banks around the world)

5) Regulation(few months ago they came out with the so-called uptick rule for short selling activity and yesterday they said we can't short sell a financial stocks)

I have been saying a lot and i think the thing i said maybe too complicated so i'll try to say it as simple as possible. First of all, why these financial institutions get into huge trouble?

The reason: Bad investment choices, failed financial leverage management and others. SO IT MEAN THEY GOT INTO TROUBLE NOT BECAUSE OF THEIR SHARE PRICE. NO COMPANY WILL GO BANKRUPT IF THEIR STOCK PLUNGE BECAUSE SHARE PRICE ONLY INDICATE FUTURE POTENTIAL OF A COMPANY. IF A COMPANY IS HEALTHY BUT THEIR SHARE PRICE FALL, THEN THEY CAN DOES A SHARE BUY BACK!

Still the regulators tend to save these companies with liquidity and maintain their share price. Stability of the share price will never help the future performance of a company because NOW the stability is determined by federal reserve and not investors. Liquidity will be the last thing you wanna give to rubbish companies because they will waste it again. If a company worth 140 billion dollar a year ago can come all the way down to less than 10 billion dollar, you know their ability to waste money. It's like a naughty child, the last thing you wanna give to him is sweets and cookies because it never help!

So all these steps to save these financial institutions will never work simply because it are not the medicine to the disease happen to our economy. Of course no company will be in trouble if the economy itself is strong.

I have wrote over and over again how to save the economy so i am not gonna repeat that. I remember George Bush once said "god bless America". Well, if they continue to manage the economy like that, only god can save the economy, no one else can.

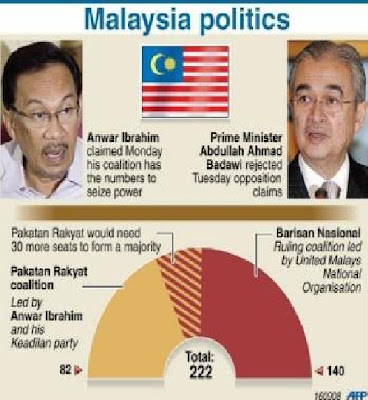

Anwar's Option

There are many roads that can lead to power for the Pakatan Rakyat alliance if opposition leader Datuk Seri Anwar Ibrahim indeed has the support of a majority MPs in his hand.

Today, the so-called "prime minister in waiting" demanded that Prime Minister Datuk Seri Abdullah Ahmad Badawi convene Parliament next Tuesday to move against a motion of no confidence against the ruling Barisan Nasional coalition.Next Tuesday is, of course, the day before Anwar goes back to court to face sodomy charges, in a trial he has claimed is politically motivated to stop in the tracks his challenge against the BN.

Such a move appears designed to play up the urgency of his moves to take power, and remove the threat of his court case.

By calling for a vote just days after Sept 16, when he failed to take power according to his self-imposed deadline, he is strengthening his case in his contention that he has the support to form the government.

The prime minister does not need to bring Parliament back into session on Anwar's say-so, and is not likely to.

And this will certainly lead to assertions from the opposition that Abdullah fears losing the vote.

Whatever happens, the stalemate will continue.

Constitutional expert Prof Abdul Aziz Bari believes that the Yang di-Pertuan Agong can also intervene to break the impasse.

"We are heading towards a stalemate," he told The Malaysian Insider.

But he points out that under Article 40a (2) of the Federal Constitution, the King may use his discretion to either appoint the prime minister or withhold consent for the dissolution of Parliament.

According to Abdul Aziz, the King could summon Anwar to the palace to furnish him with the list of MPs he claims supports him, and verify the claim by summoning the MPs as well.

He cited the initiative of the Rulers of Selangor and Perlis post-March 8 when they dealt directly with the elected lawmakers to ascertain their support.

"Should the claim by Anwar prove to be true then he needs to tell Abdullah to resign. This is actually putting the last nail in the coffin for as soon as Anwar manages to get 112 MPs with him, Abdullah no longer has the right to be in the PM's office," he said.

However, political analyst Khoo Kay Peng feels the most democratic answer is simply to wait until Parliament reconvenes on Oct 13.

"Anwar is using the only way possible now by asking the PM to resign. But it will not happen because even if Abdullah wants to comply, Barisan Nasional will not allow it. They would rather get rid of Abdullah than cede government," he told The Insider.

According to Khoo, there is no mechanism that Anwar can use to trigger a change in government until the opposition submits a motion of no confidence where legislators can vote democratically.

That is exactly what Anwar is now trying to do.

Sources: Malaysia Today

And Now They Blame The Short Sellers!

When a company is healthy and have a conservative financial leverage, nothing can hit them. When short sellers wanna short sell the stock, they is a simple action call share buy back although i bet short sellers won't target any stock that have sound fundamental. Only the companies that is in trouble and will collapse soon will be targeted. So short selling will never make a healthy company bankrupt, it will only make a trouble company bankrupt faster.

We already know short selling is allowed just like investor can buy share with money they doesn't have. So if a investor or trader can buy share with money they doesn't own, why can't a investor or trader sell share that they doesn't own?

So Financial regulators in the U.S. and U.K., attorneys general in New York, Texas and Connecticut, and the three largest U.S. pension funds all began cracking down on short sellers this week. Furthermore the SEC said yesterday it may require hedge funds to disclose short-sale positions and subpoena their communications, while the Financial Services Authority in the U.K. banned short sales of financial shares for the rest of the year.

Look like these "smart people" aren't smart after all. They still don't understand what went wrong. They still think stock market crash is the cause of economy slowdown. According to the pirate from pirateofbatavia.blogspot.com

So next few days is the best opportunity for you to sell your shares and get out of position. The worst is yet to come. This is just the small taste of unsound economy.

Until the Regulators and Officials realize the problem, the economy will continue head toward hell.

Good Luck

Here is my statement to Salvatore Dali of the Malaysiafinance.blogspot

"There is nothing you cannot save if you throw enough money at it."

I really can't believe you say this! It's more than stock market.It's more of the fundamental of the economy itself. an economy of a nation can't be saved by just printing money and pump it in the system. It is much more complicated than that.

Yesterday i sent you the youtube link of what peter schiff is saying but look like you ignore it!

Yesterday was 18 september 2008, exactly one year anniversary of the first rate cut(50 basis point) by federal reserve and look what happen, at least 5 companies about to bankrupt! and economy is sinking to hell!!!

You may say if fed didn't intervene it would be worse, well, if fed didn't intervene in the first place, the us economy would be much better. They created the dot com bubble and it burst in 2001. Then to "stimulus" the economy fed(led by Greenspan) encourage US people to spend money and cut the interest rate all the way til 1.00% and created the housing and credit card bubble(about to burst). Now the housing bubble is bursting and fed inject even more money! They repeated the mistake they done in 2001 by creating more and bigger economy bubble. The last thing you wanna do when you in a hole is dig deeper and that's exactly what the fed is doing.

This is what gonna happen to US if they keep doing the same thing:Their inflation rate will shoot up as the money supply increased heavily.(yesterday gold price up 80 dollar per ounce is the prove), their dollar will depreciate and their debt will be so huge they won't be there to control the world economy(US change from the world biggest creditor in the '70s to the world biggest debtor now) and by that time, the economy of the world will collapse just like what happen to the great depression 1929.

Well just give you a taste of what gonna happen. You can ignore me again Dali but that is gonna happen. Like the MasterCard ad we use to watch on TV: there are really something money can't buy and that's sound economy that the US and rest of the world really need!

So you might ask how? how to save the economy now? First fed should stop acting like this. Let the economy recover itself. The economy have to take the painful medicine to cure and heal itself. Let all the bubble created by the fed and people of America burst and start all over again. It is the only way like it or not.

Good Luck!

Words from the Expert on The Real SItuation Of US Economy And Solution To It!

18.9.08

UCL matchday 1 result

Matchday 1 - 16 September 2008

| Group | Home | Away | |||

|---|---|---|---|---|---|

| A | Chelsea | 4-0 | Bordeaux |  | Report » |

| A | Roma | 1-2 | CFR |  | Report » |

| B | Panathinaikos | 0-2 | Internazionale |  | Report » |

| B | Bremen | 0-0 | Anorthosis |  | Report » |

| C | Basel | 1-2 | Shakhtar |  | Report » |

| C | Barcelona | 3-1 | Sporting |  | Report » |

| D | PSV | 0-3 | Atlético |  | Report » |

| D | Marseille | 1-2 | Liverpool |  | Report » |

Matchday 1 - 17 September 2008

| Group | Home | Away | |||

|---|---|---|---|---|---|

| E | Man. United | 0-0 | Villarreal |  | Report » |

| E | Celtic | 0-0 | AaB |  | Report » |

| F | FC Steaua Bucureşti | 0-1 | Bayern |  | Report » |

| F | Lyon | 2-2 | Fiorentina |  | Report » |

| G | Porto | 3-1 | Fenerbahçe |  | Report » |

| G | Dynamo Kyiv | 1-1 | Arsenal |  | Report » |

| H | Juventus | 1-0 | Zenit |  | Report » |

| H | Real Madrid | 2-0 | BATE |  | Report » |

Nice try, All Those Central Banks

Today these central banks planned to pump $247 billion into the financial system and regulators cracked down on abusive speculation against bank shares.

Russia and China will act too. Russia and China took steps to stanch declines in their stock markets. Russian President Dmitry Medvedev said the government will spend 500 billion rubles ($20 billion) to support the shares. China will scrap the stamp duty on stock purchases and buy shares in three of the largest state-owned banks to shore up investor confidence, the official Xinhua News Agency reported.

As a person who studied economy, here i will explain to you why this step won't work.

Under normal circumstances, a slowdown in economy required central bank to apply the expansionary monetary policy, which mean lower the interest rate and increase the money supply to stimulus the economy and increase the growth of the gross domestic product(GDP) and decrease the unemployment rate.

However, the circumstances now are not normal. We are not just encounter a economy slowdown problem but also high inflation rate problem. When these two problem occurred together, we call it a stagflation.

According to Alban William Phillips, a New Zealand-born economist, there is an inverse relationship between money wage changes and unemployment.He proved the theory using data from a lot of countries. In 1960, Noble Laurette Paul Samuelson and Robert Solow took Phillips' work and made explicit the link between inflation and unemployment: when inflation was high, unemployment was low, and vice-versa.

All those central banks increase the money supply will no doubt increase the GDP and lower unemployment rate, but it will also increase the inflation rate. As we all know the inflation rate of countries all over the world is already at a very high level, another increase in the inflation rate will make the inflation rate even higher. He call a very high inflation a "hyperinflation" just like the problem those South America Countries is facing now. Not only that, a high inflation rate will decrease the value of the currency of that particular country.

According to economist, inflation rate is so much harder to control compare to GDP and unemployment. So they suggest if both problems exist, we should deal with high inflation rate first before solving the Slow GDP growth and high unemployment problem.

However, those central banks are try to do the opposite thing, they try to solve the slow growth of GDP and high unemployment rate first before the high inflation rate. Yes i admit they may succeed in solving all those problems but at a much higher cost. Furthermore maybe by the time they succeed in solving the GDP and unemployment problem, the inflation problem already go to the level when they won't be able to control. By that time, the US economy may be as weak as Argentina's or Bolivia's. The Currency of US will be fallen to hell and like Don Harrold said, American may need a bag load of dollar to buy a bread. Soon the world economy will also badly affected.

These central banks are taking the actions that is too risky for all the normal citizen like us. If they succeed, our life won't change much unless you are a wall street trader or owner of a large company, but if they fail, we as a normal citizen will suffer the most while those rich people continue to live their life.

Why not, Dato' Seri Abdullah???

WHY NOT?

Why say no to for the emergency session of Parliament?

The Malaysian really want to know the truth as both parties(Barisan National led by Abdullah and Barisan Pakatan Rakyat led by Anwar) continue to say they are telling the truth.

BN leader keep saying that Anwar is lying about the September 16 power transition plan and BN government is still very strong and unite.

Pakatan Rakyat Leader Anwar keep saying that he is not lying about the 916 plan and have enough MP to form new government.

So here is my opinion: this emergency parliament session is the perfect way to prove each other wrong. If Anwar not successfully during the emergency parliament session in securing enough MP, then Malaysian will feel like cheated by Anwar and will never trust him again. Furthermore, it may even be a good way to secure public mandate in the next general election. Yet Abdullah chooses the emergency session of Parliament is unnecessary.

This action will raise more question on who is telling the truth. Here's a article a paste from Suara Keadilan net:

PM enggan adakan sidang tergempar, Abdullah penakut

Khamis, 18 September 2008 • Kategori: Berita Semasa, Berita Utama, NasionalKUALA LUMPUR, 18 SEPTEMBER (SK) - Perdana Menteri, Abdullah Ahmad Badawi menunjukan ketakutan beliau terhadap ahli-ahli Parlimen berikutan keengganan beliau mengadakan sidang tegempar Parlimen pada 23 September ini seperti yang diminta Ketua Umum, Anwar Ibrahim.

Mengulas mengenai hal ini, Ketua Penerangan KeADILan Tian Chua menyifatkan Abdullah sebagai penakut untuk berdepan kenyataan dan hanya berani untuk menafikan.

“Abdullah menunjukan sifat penakutnya untuk berdepan kenyataan.kalau Abdullah tidak percaya tentang jumlah Ahli Parlimen yang kami ada, beliau sepatutnya berani adakan sidang tergempar,”kata Tian Chua.

Petang tadi, Ahli Parlimen Sungai Petani, telah mewakili Pakatan Rakyat untuk mengutuskan surat kepada Abdullah Badawi bagi mengadakan sidang Parlimen tergempar bagi membolehkan usul undi tidak percaya terhadap Perdana Menteri dijalankan.

Walaubagaimanapun, dalam sidang media selepas mesyuarat Majlis Tertinggi Umno, Abdullah berkata tidak ada keperluan untuk adakan sidang tergempar.

“Saya tidak lihat apa perlunya untuk memanggil sidang khas di Parlimen,”kata Abdullah di Menara Dato Onn petang tadi.

Sebelum itu, Anwar dalam sidang medianya menuntut agar sidang khas diadakan atau beliau akan memilih jalan lain bagi memastikan peralihan kuasa kepada Pakatan Rakyat.

“Jika permintaan tersebut ditolak, kami pemimpin Pakatan akan berbincang segera untuk mengambil pilihan lain,” katanya di Ibu Pejabat KeADILan di Petaling Jaya.

Katanya, sekiranya Abdullah tidak percaya dengan jumlah Ahli Parlimen, beliau mencabar Perdana Menteri diadakan sidang tergempar dan menurutnya lagi, majoriti ahli Parlimen sudah bersama Pakatan Rakyat

“Kamu lihat dalam sidang Parlimen nanti jika tidak percaya,” katanya.

How can you not react to that?!Anwar Demands Special Malaysia Parliament Session

Anwar Ibrahim is telling reporters Thursday that the vote needs to be held no later than Tuesday to “deliberate” on a motion of censure and no confidence in the leadership of Prime Minister Abdullah Ahmad Badawi.

Parliament is currently in recess.

Anwar says he has sent a letter to Abdullah to demand the meeting, and expects “an immediate response.”

He says any “delay in his response would be interpreted as nothing short of sabotage” of democracy.

Anwar claims he has the support of more than enough lawmakers from the ruling coalition who want to defect to bring down the government.

17.9.08

Bernanke-Paulson Coalition: AIG Is Next!!!

The market like Fed decision to keep the key rate unchanged at 2% as that's the right thing to do and everybody knows it. However just when we thought FED make the right call, they blow us out with yet another hilarious and stupid decision: America International Group (NYSE:AIG), America largest insurer will be bail out over by Federal Reserve for 85 Billion Dollar. The Federal Reserve will provide a two-year loan, take 79.9 percent of the New York-based company's stock and replace its management because ``a disorderly failure of AIG could add to already significant levels of financial market fragility,'' according to a statement by the central bank late yesterday.

So after Bear Stearns, Indymac, Freddie Mac, Fannie Mae, AIG is next.

85 Billion dollar may seem like well spend because "this insurance company is too huge to collapse!" However, 85 billion dollar is really a lot and will go to hell forever.

How many families can 85 billion dollar save? How many bridges can 85 billion dollar built? How many school can be built with 85 billion dollar? How many poor child can be saved with 85 billion dollar? How many AIDS, Malaria, Bird Flu and cancer patient can be save with 85 billion dollar? How many house destroyed by Gustav and Ike can be rebuilt with 85 billion dollar? How many subsidy and jobless claim can be give away to jobless and poor American with 85 billion dollar? How many scholarship can be given to student with academic excellency?

Yet the US government choose to spend 85 Billion US Dollar to save a insurance company, to save those wealthy and arrogant man that owned the company so that the rich can remain rich and poor remain poor. The US government some how choose to back these small group of rich people back and ignore the large amount of poor people that suffer for their life.

You may say AIG have to be saved. Why? What happen if they are left to die?

AIG is a giant company, they have world of money and they run one of the most profitable business in this world, insurance business. They make wrong decisions, they invest they money unwisely got loss huge amount of money, they choose the risky investment and got their hand burned and yet US government saved this bad company from bankrupt. SO NEXT TIME IF I MAKE THE WRONG INVESTMENT LOSE MY MONEY, WILL FED PAY OFF MY LOSSES?

Even if AIG is left to die, those rich people will become like you and me, the average Joe, and we are happy to live like an average Joe. But somehow Fed think those rich people can't be average Joe because they just can't. They are destined to sit their fat ass on the Ferrari and live like a king while we are on our own.

So, if you are a American, like Don Harrold like to say you should get out of debt fast. Don't put your next on the chopping block of these financial company cos they will kill you nastier than the Leatherface. Even if you are not American, get away from USA. After all the US economy is controlled by the Bernanke-Paulson Coalition!!!!!

Is Anwar Lying??

The time is 12.50am September 17th 2008.

Yesterday was Malaysia day. 45 years ago Sabah, Sarawak and Singapore joined Malaya to form Malaysia. It was the day all Malaysia will remember especially those who live in Sabah and Sarawak.

16th of September 2008 was a day to remember for some reasonS:

1) Stock market of the world tumble with bad news on Lehman Brothers (NYSE:Leh), America International Group(NYSE:AIG) and the financial stocks.

2) News on middle east as intelligence suggests Iran worked on nuclear missile.

3) The Mexican prison riot.

4) The Ike storm hurt the US and oil industries as oil refineries are forced to shut down.

5) Thailand political chaos.

But for Malaysian, today is probably the most important day of the year as the Pakatan Rakyat led by Anwar Ibrahim said they have more than enough MP to form a new government. FYI, they will need at least 30 MPs from Barisan National led by UMNO and Abdullah.

On 15th September 2008, Anwar said he will make a big announcement and eventually he said he have more than 31 MPs from BN and a new government is coming.

So i believe most if not all Malaysian are patiently awaited the take over party by the opposition party although the ruling coalition party keep saying that nothing will happen to Malaysia Government.

The big moment came at 2.00pm when Anwar had a press conference at PKR HQ at Petaling Jaya and said he had to delay the power transition process for a few days for smooth transition.

I still Remember Anwar's speech on April the 25th 2008: “God willing, we will be there. If not next month, the following month, then if not June or July, (it will be) on Merdeka (Aug 31) or Malaysia Day. I think we should not go beyond that (Sept 16),".Yet we were forced to wait "few more days" for that to happen.

On the other hand, Anwar said many times that he already has enough crossover MP from BN for him to form a new and "improved" government.

So it all come down to who you trust, Anwar or Abdullah?

Well i guest after a peace and calm September 16th 2008, many Malaysian will change their view before and distrusted Anwar as they so eager to have a Pakatan Rakyat Government they can't wait any longer than 16/9/2008.

So we shall wait for another "few more days" for that to happen. As David Beckham once said "never say never" so don't rule out anything yet as the fun has just begun. For the first time in Malaysia history, the ruling BN will have a strong enough opposition party to fight against.

For Barisan National Government, their MP and supporters, congratulation, you proved anwar wrong today and wish you all the best in ruling Malaysia for a better tomorrow.

For Pakatan Rakyat, their MP and especially their supporters, today you might be the second best but we know you done the best you can. You have waited your life for a better Malaysia and why can't you wait a little more while. Don't hate anybody because nothing happened on 16/9/2008, trust you leader and i am sure they will do the best for you.

HAPPY MALAYSIA DAY!

16.9.08

Will another round of Fed Rate Cut help?

You might ask when is the first time Dow closed and stay below 11000? The answer is July of 2006 where Dow stay below for 2 weeks.

As i wrote this article, Dow future at minus 39, rebounded from minus more than 100 earlier. The reason is simple, another round of rate cut. The fed funds future shows tremendous hike in people bet federal reserve will cut its key rate to 1.75 from a mere 5% few days ago to more than 75% today. Even the percentage of fed rate cut to 1.50 is higher than unchanged at 2.00.

So here's the one million question: will a fed rate cut really help?

Here's what we all read in the economic book: the interest rate is the cost of borrowing. When economy is at a bad situation, central bank of a country will does what we called an expansionary policy, which is lower the interest rate and increase the money supply. The lower interest rate mean lower borrowing cost will make people borrow money to invest in various location such as spend it as household consumption, use it for business or invest in stock market, etc.

I know that is boring so here's the interesting part: the monetary policy only will work when the economy is performing at normal situation, meaning the only problem occurred is economy slowdown, there are no inflation problem, government and all the people debt level are at normal level, the business environment is perfect for investment etc.

But the problem now, the inflation rate of US is very high due to high energy prices, the debt level of us government and American is at all time high and the business environment of US is well, messy and "inhabitable".

So here is the problem you will face when fed cut the interest rate: the lower borrowing cost will make American borrow more money hence their debt level will go so high and they won't afford to pay back, they spend the money and make the US inflation rate become even higher and they invest in business and stock market and loss it as the business environment in US is horrible. So you will end up with debt all over your waist, the inflation rate is so high until even a bread cost you 3 millions dollar and you will loss all the money you borrow to buy shares etc.

And that's exactly happened to US since Ben Bernanke first cut the rate last September from 5.25 to 4.75. American people are poorer and poorer. We always talk about the housing market slump, the sub prime mortgages problem but do you know a big bubble called credit card market is about to bust. American spend so much more money than what they can afford and got themselves in big credit card debt problem. Some said US credit card debt reach 100 trillion dollar. Imagine that 100 trillion dollar worth of money out of economy, what will happen?

So now the fed rate already cut to 2.00% and yet they wanna cut it again. I hope Ben Bernanke knows what he is doing but really, he is pushing the America economy to hell. Jim Rogers said before fed should not keep cutting interest rate. When the economy is poison and bacteria is inside, let the economy heal itself, don't give it disturb it as fed will only make US economy closer to hell.

So this is what you should do: if you have position, this is your opportunity to sell it. Market will react positively (stupidly) towards speculation that fed will cut rate. Sell it and sleep well after that. If you do not have any position, don't ever touch it except you think you are a dare devil. Keep you money safe and cash is king. Risk management is more important than ever.

Anwar: We're ready to form new government

"Tonight on the eve of Malaysia Day, we are ready to form the government tomorrow," he said to loud cheers from the jubilant crowd.

He said that he had the required number of parliamentarians to form the government.

According to him, Pakatan Rakyat has submitted a letter to Prime Minister Abdullah Ahmad Badawi today seeking a meeting for a smooth transition of power.

"Tomorrow is the day we are ready to form government. But the best time, I tell you, is when we meet the prime minister.

"A peaceful transition is paramount," he added.

He, however, did not provide more information on how many MPs Pakatan has in the bag and the number of government defectors.

Anwar will need at least 31 defectors from BN and perhaps over 40 for a stable Pakatan government.

The massive crowd had gathered at the Kelana Jaya stadium in Petaling Jaya tonight to celebrate Pakatan's 'Hari Malaysia' celebration.

ISA dragnet slammed

Anwar, who began his speech at 10.15pm, emphasised the importance of Sabah and Sarawak to Malaysia.

He also criticised the ruling Barisan Nasional for pursuing a divide-and-rule agenda at the expense of the two east Malaysian states.

"This is the first time ever a celebration of this scale is being held to recognise that we are one - that Sabah and Sarawak are part of Malaysia," Anwar told the crowd.

He added that he would declare Sept 16 a national holiday when he takes over the government.

Anwar also slammed the Abdullah-led government of practising racial politics, which he said led to the ISA arrests of three people.

He urged the majority Malays not to be swayed by BN policies.

"The Ketuanan Melayu (Malay supremacy) benefitted only the rich and elite Malays, not you," he said.

Most of those in the crowd are there in the belief that PKR leader Anwar would make an important announcement tonight on the formation of a new government, which Anwar has repeatedly claimed he would do by tomorrow.

High expectation

Earlier Anwar entered the venue at 9.40pm to wild chants of ‘Reformasi!' and ‘Merdeka'.

Many Pakatan leaders were already at the venue, most of them also believing that Anwar would make an important announcement at the rally.

Penang Chief Minister and DAP secretary-general Lim Guan Eng, when asked if there would be a surprise announcement, merely said: "Wait for Anwar".

Guan Eng and DAP veteran Lim Kit Siang had earlier entered the stadium to loud cheers.

Many people on the ground whom Malaysiakini spoke to also expressed confidence of an impending change.

"He may reveal the first batch of defectors and maybe on how they will approach the king.

"I think they will wrap it up and form a new government by the end of this month," said retiree G Maniam.

‘I am surprised at how fast things are changing," said another Pakatan supporter at the stadium, Anthony Tong.

The 52-year-old accountant from Cheras said that he would not be disappointed even if Anwar managed to seize power by the end of this year.

Sources: Malaysiakini

15.9.08

Great Depression 2008

Well everybody knows the great depression of 1929, the stock market crash on October 29, 1929, known as Black Tuesday, the gdp sink into hell, the US government and citizen got themselves into the world of debt.......

US economy today really look similar to their 1929 counter part.

On may 30th 2008, the fifth largest investment bank in USA, Bear Stearns got into huge trouble and eventually got bailout by Jp Morgan with big help from Federal Reserve (30 billion). As a result, us stock market tanked.

Yesterday, US forth largest investment bank, good old Lehman Brothers, file for bankrupt as no bank dare enough to help him.

Second largest US investment bank, Merrill Lynch on the other hand also got them self in huge trouble.

Not only that, Washington Mutual, AIG, ubg and most of financial company all in huge trouble their share price going down like those WTC towers fell on 9/11/01.

I am beginning to wonder how can people still feel bullish about this stock market when the economy of the richest and most dominant country are like a third-degree cancer patient waiting to die soon. After all the bad news today, i am sure some people will feel positive tomorrow and start buying shares of financial because they feel "it can't go down any further. This is exactly like last week Freddie mac and Fannie mae bailout by federal reserve and people getting excited and started to shop.

Well i warned those people who bought shares on the day fre and fnm got bailout and look what happen, they stuck with their shares at least until mid 2009 or they can choose to end the pain fast and sell to other bullish (or should we say stupid) person.

Here's my opinion: don't buy anything that generate their income through stock market, derivative, foreign currency exchange or any other type of financial market in this world. That includes investment bank, commercial bank, insurance company, hedge funds, unit trust company etc. For me, the only large US investment bank that is safe from "great depression 2008" is Goldman sachs simply because the hold financial market in US are controlled by ex-GS staff. So watch out for the second largest, merrill lynch and third largest, margan stanley.

The US economy are sinking to hell and why u still wanna buy shares? you may end up holding shares of worthless company with no money to even buy a dinner for yourself. So stop the bullish nonsense and get out fast before you are eaten!

11.9.08

How To Spend 940 Million British Pounds?

Well you may have your own answer but according to the new owner of Manchester City, Dr Sulaiman Al-Fahim, here are his way:

Product 1: Cristiano Ronaldo (135 Million Pounds)

No doubt he is one of the best midfielder in the world now and after helped Manchester United won their double last season, his value certainly skyrocket. However is he really 3 times as worthy as Zinedine Zidane(transferred from Juventus to Real Madrid for 46.5 million pounds, the highest ever in football history)? I think C. Ronaldo is severely overrated and i doubt he will be able to keep his form for next 3 seasons

Product no 2: David Villa (120 million pounds)

He is the backbone of Valencia team forward and one of the fastest and best attacker in the world. During Euro 2008, most people think Fernando Torres was the best performing Spanish attacker but Villa absolutely proved them wrong. He helped Spain won their second ever major international trophy and was awarded the golden boot for most goals scored. However, 120 million? Seriously you can even buy a Serie A club with that amount of money!

Product 3: Kaka (80 million pounds)

2 season ago, Kaka won every major trophy a footballer can won. Fifa player of the year, European Player of The Year, Fifpro player of the year, Serie A player of the year, Uefa Champions' League top scorer, Uefa Champions' League Best Player.......... and very little people will doubt Kaka as the best footballer today. However last season Milan was fifth in the Serie A and have to play for second class competition, UEFA Cup this season so will you spend 80 million pounds on the playmaker of a second class club in Europe?

Product 4: Lional Messi (80 million pounds)

Messi is one of the best attacking midfield in the world. His show at Barcelona and Argentina national team is astonishing. He help Argentina won the football Olympics gold medal at Beijing Olympics and most important asset of messi is his youth. He is only 21 years old. So i would say there is some rational for a club to spend 80 million pounds but still it's too high.

Product 5: Gianluigi Buffon (70 Million pounds)

Very few will doubt that Buffon is the best goal keeper in the world. Some even think he is the best goal keeper ever. Although there are Cech, Valdes, Casillas, Dida, Van Der Sar and many other goal keeper in his way, Buffon will widely considered as the best. He won the 2006 world cup and really, he was the best performing Italian in that competition. He only conceded twice during that competition and one of that was scored by Cristiano Zaccardo, his own teammate. However, Buffon is 30. How many more year can he play?

Product 6: Fernando Torres (60 million pounds)

He is considered the best foreign player in Liverpool football history. he helped Spain won the Euro 2008 and scored the only goal in the final. He is the absolute first choice striker no matter in Atletico Madrid or in Liverpool. He is only 24 and he is consistent. 60 million still considered too much for a player that never won any individual award.

Here are the rest:

Product 7: Cesc Fabregas (60 million pounds)

Product 8: Dimitri Berbatov (60 million pounds)

Product 9: Rio Ferdinand (50 million pounds)

Product 10: Stephen Gerrard (45 million pounds)

Product 11: Luis Fabiano (44 million pounds)

Product 12: Samuel Eto' (40 million pounds)

Product 13: Michael Essien (35 million pounds)

Product 14: Ruud Van Nistelrooy (32 million pounds)

Total: 940 million pounds!!!